The browser you are using is not supported. Please consider using a modern browser.

Keep Your Mortgage Leads: Think Not Yet v. No

In less than a month, we’ll be waking up in 2021 with collective hope that the year ahead will bring more stability and fewer unwelcome surprises than we had in 2020. With renewed focus, many mortgage loan originators are preparing their businesses now to optimize their financial growth and maintain a steady pipeline.

In less than a month, we’ll be waking up in 2021 with collective hope that the year ahead will bring more stability and fewer unwelcome surprises than we had in 2020. With renewed focus, many mortgage loan originators are preparing their businesses now to optimize their financial growth and maintain a steady pipeline.

But where is a good place to start?

In our last edition of the Xtra Credit e-newsletter, our Vice President of Sales Matt Hydrew illustrated why borrower care is the key to 2021 success. In part two, we’ll start showing you how to put it in action.

There are different methods of practicing borrower care that mortgage loan originators can implement on an individual level or even on a company level. Rosa Mumm, our product support manager and host of our “Xpert Insights” video series, shares how borrower care can start with just one person and two important pieces of data: a timeline and forecasted credit score.

Turning “no” into “not yet”

“I spoke with a loan officer this year who told me the one thing he never says to a client is ‘no’ – he says ‘not yet’ instead,” Rosa explains. “With CreditXpert tools, you can tell prospective borrowers exactly when to come back, and what credit score they can expect to have when they do.”

“I spoke with a loan officer this year who told me the one thing he never says to a client is ‘no’ – he says ‘not yet’ instead,” Rosa explains. “With CreditXpert tools, you can tell prospective borrowers exactly when to come back, and what credit score they can expect to have when they do.”

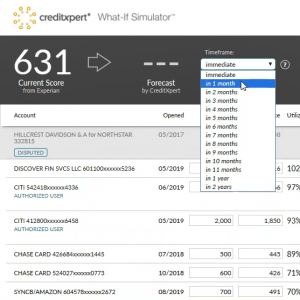

If you have a client with a lower credit score, you can help keep their dreams of homeownership – as well as your lead – alive by loading their data into CreditXpert® What-If Simulator™. Within the tool, you can forecast what their potential credit score may look like up to two years in the future if your client follows an action plan tailored to their needs. Whether it’s in three months, eight months or one year or more down the road, you may still have an opportunity to close the deal.

Sharing a specific timeline and expected credit score improvement – especially when based on their own credit report data – makes the goal seem more tangible to your client and helps clear a path to success.

“With these details,” continues Rosa, “you set yourself apart from other mortgage loan originators who may have told your lead that they can’t help now but maybe can one day.” As a result, your applicant could be more likely to return to you after the designated time period with a healthier credit score, ready to apply for the loan and get the home of their dreams.

Want to see the process in action? You can see an example and hear more details in Rosa’s new Xpert Insights video below:

Incorporating CreditXpert tools into your lead qualification process will not only help you turn more applicants into borrowers, but also get better deals for your clients.

Stay tuned for part three of our series in January, which will explore implementing borrower care on the company level. Subscribe to our Xtra Credit e-newsletter to make sure you don’t miss it!

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

Matt Hydrew, CreditXpert’s VP of Sales and Client Success, gives insight on how a year like 2020 affects mortgage lending in an article for the Progress in Lending Association.