The browser you are using is not supported. Please consider using a modern browser.

Introducing the new CreditXpert.

The only credit optimization platform that uses predictive analytics to help lenders qualify more applicants, make better offers and close more loans.

Used by the Nation's top mortgage lenders

The next generation of credit optimization is here.

Maximize the credit potential in every borrower and turn credit into a strategic growth engine at the click of a button with CreditXpert.

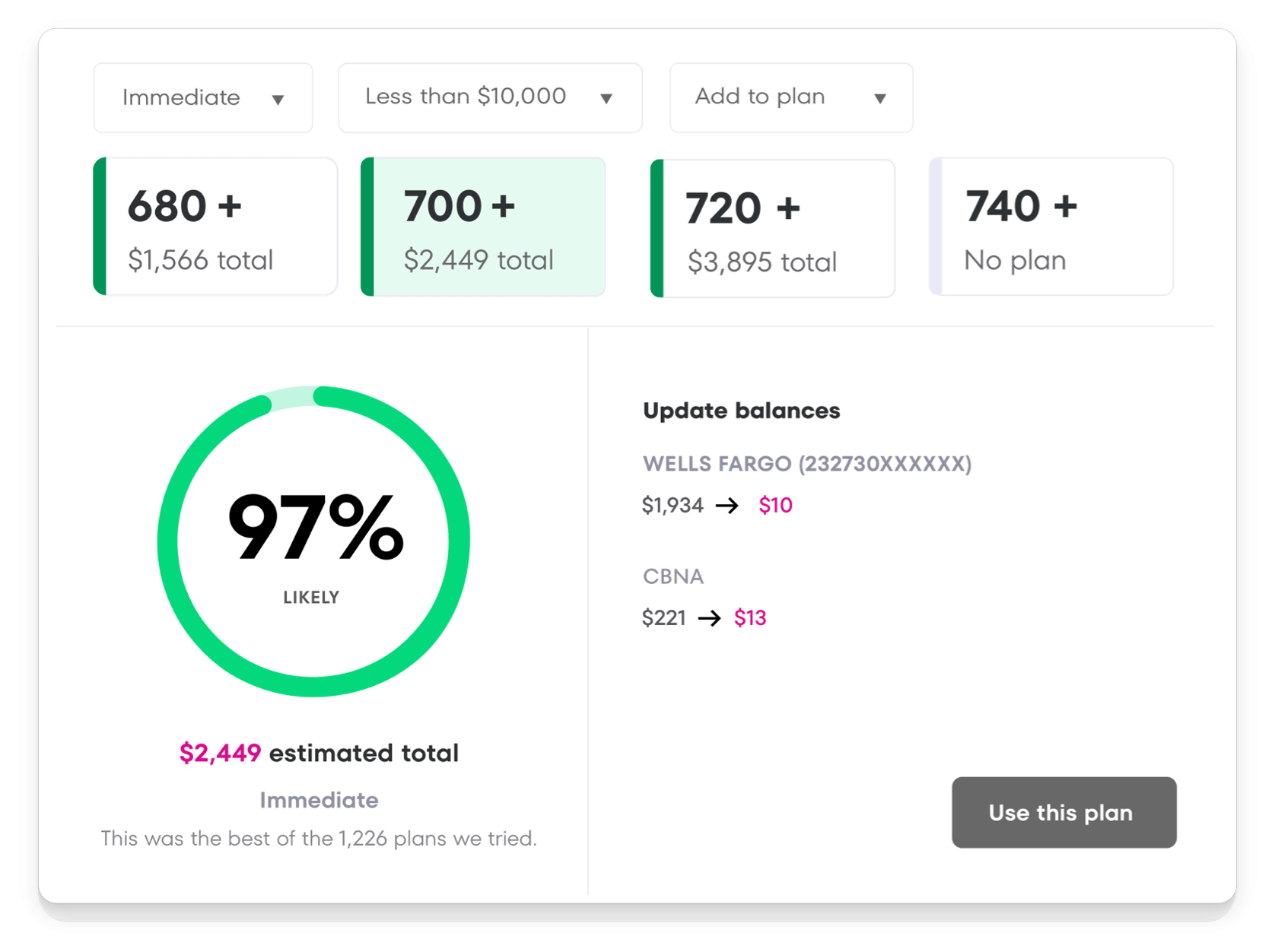

IDENTIFY: See the applicant's credit potential right in front of you.

GENERATE: Generate an optimization plan with 1 click.

TRACK: Send the plan and track the applicant's progress.

Everyone wins with CreditXpert.

Mortgage Professionals

- Convert more leads

- Qualify more applicants

- Make more competitive offers

- Lower LLPA premiums

Homebuyers

- Qualify for better loan programs

- Lower your interest rate

- Reduce your private mortgage insurance premiums

- Know that you got the best deal on a mortgage

Realtors

- Help more clients qualify

- Help clients secure the best rate

- Help clients reduce PMI

- Help increase client purchasing power

The latest credit optimization insights

Compete for every loan, regardless of credit band.

Not just for exceptions.

Position applicants for the best rates and terms. CreditXpert helps you eliminate guesswork, and reduce surprises at underwriting.

See how others are using our platform.

Equity Mortgage Lending

Ken met with a client whose credit appeared to be exceptional. With interest rates at historic lows, the client wanted to refinance their mortgage. When Ken pulled his client’s credit score, they were both perplexed that it was 699 – relatively low given their overall credit standing. The client couldn’t figure out the reason their score wasn’t higher.

100+ Point Increase on Credit Score

HomeBridge Financial Services

Mark’s client needed to raise her credit score from 590 to 640 – just 50 points – to have a chance for an FHA loan. Most of her debt was due to credit card balances. Mark used CreditXpert® What-If Simulator™ to look for ways to pay down the debt that wouldn’t require a lot of funds.

50 Point Increase on Credit Score

PrimeLending

Rod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site.

18 Point Increase on Credit Score