The browser you are using is not supported. Please consider using a modern browser.

The confidence you need to hit a target score.

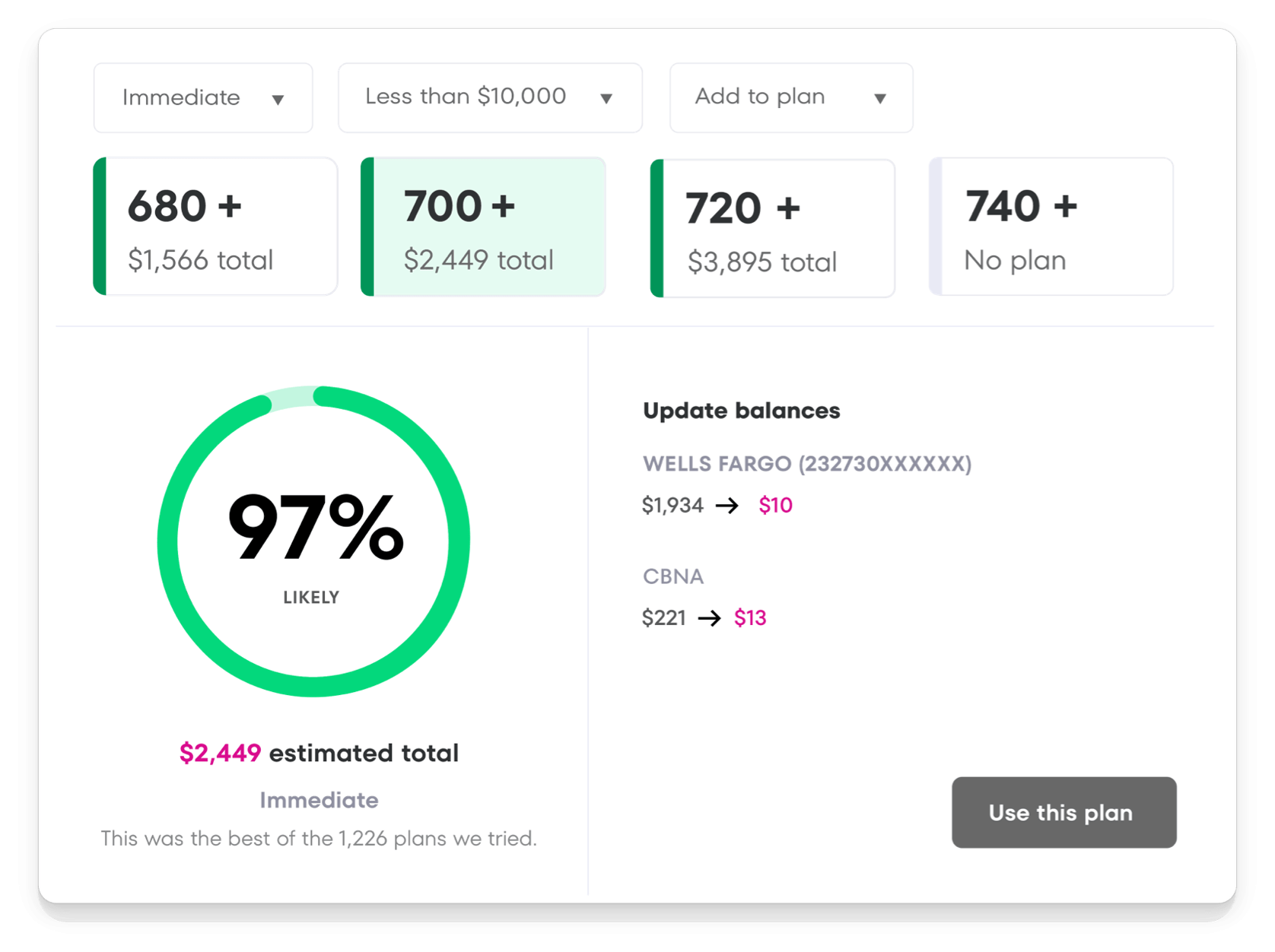

Our predictive AI-driven credit optimization engine presents you with a recommended plan – and the likelihood of your borrower reaching a target score. All you have to do is click “use this plan."

Maximizing pipeline conversion starts with a CreditXpert plan.

Nothing hurts your pipeline more than borrowers that fall short of a qualifying score. Finding a precise route to a qualifying score with a simple click.

Everyone wins with CreditXpert.

Mortgage Professionals

- Convert more leads

- Qualify more applicants

- Make more competitive offers

- Lower LLPA premiums

Homebuyers

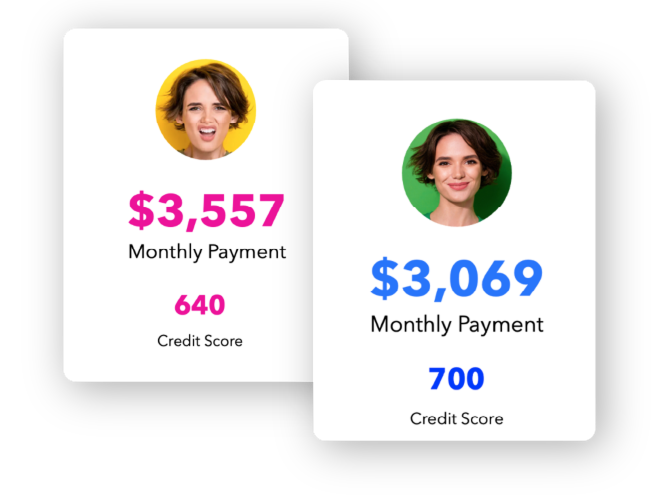

- Qualify for better loan programs

- Lower your interest rate

- Reduce your private mortgage insurance premiums

- Know that you got the best deal on a mortgage

Real Estate Professionals

- Help more clients qualify

- Help clients secure the best rate

- Help clients reduce PMI

- Help increase client purchasing power

Get CreditXpert

Quick Start

Built for Brokers and Originators with fewer than 20 professionals.

$28 per plan

- Up to 20 user seats

- Seamless connection to credit reports

- Full platform access

- Access to training videos + support

Mid-Size

Built for lenders with a state or regional footprint.

Custom

- Everything from Quick Start, plus:

- Unlimited user seats

- Always on connection that delivers real time insights

- Dedicated client success manager

- Custom pricing

Enterprise

Designed for national lenders that operate at scale.

Unlimited Users

- Everything from Mid-Size, plus:

- Monthly business and analytics review

- Dedicated onboarding, training and enablement coordinator

- Advanced custom pricing options

Real Estate Pros

A new way to find mortgage professionals that use CreditXpert.

Coming Soon

- Free search tool exclusively for Real Estate Pros

- Thousands of mortgage professionals nation-wide

- See if your mortgage partners are using CreditXpert

What mortgage professionals are saying about CreditXpert.

The latest credit optimization insights