The browser you are using is not supported. Please consider using a modern browser.

Introducing the Mortgage Credit Potential Index™

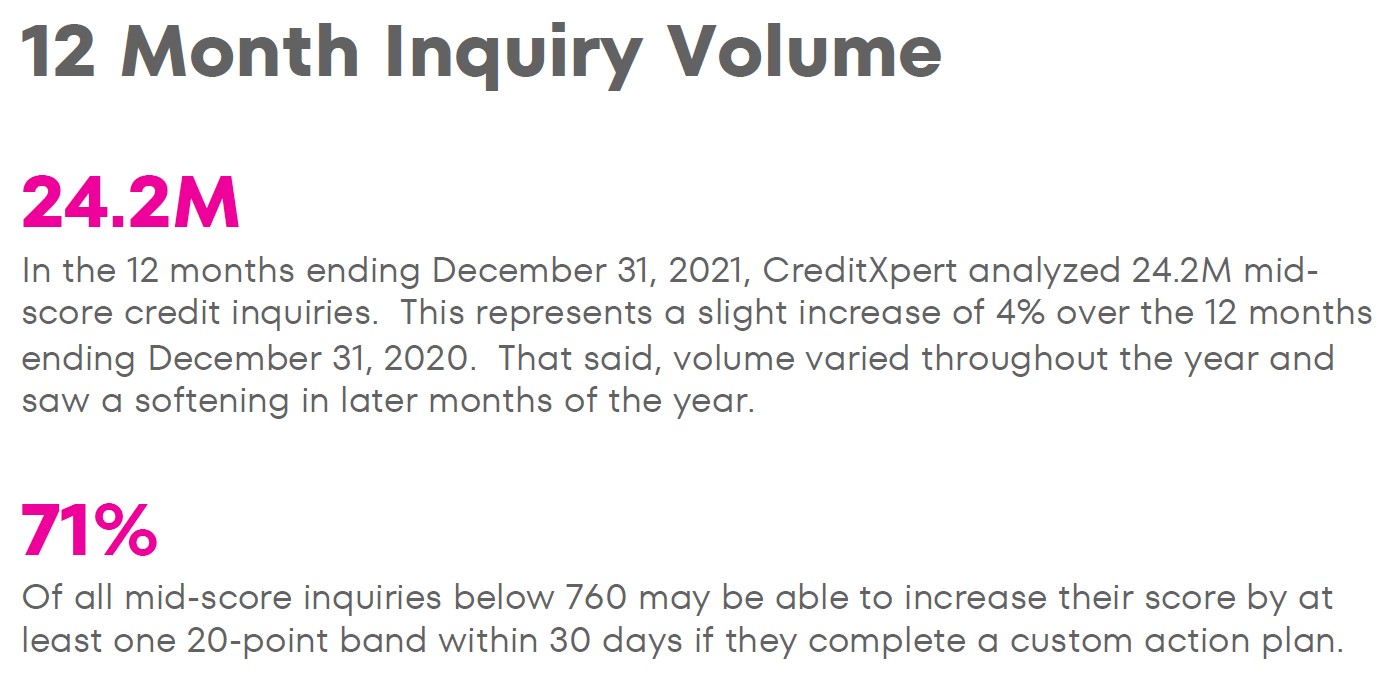

The Mortgage Credit Potential IndexTM (MCPI) is a monthly reporting of mortgage credit inquiries analyzed by CreditXpert’s predictive analytics platform. Read the full press release here. The MCPI highlights the volume of mid-score mortgage credit inquiries by 20-point credit bands between 360 and 850. When compared to prior months and years, the MCPI serves as an indicator of changes in query volume.

Click here download the full MCPI

The MCPI also leverages CreditXpert’s proprietary predictive analytics engine to highlight the potential increase each applicant may be able to achieve within 30 days if they completed a custom action plan[1] that is generated by CreditXpert’s proprietary predictive analytics engine, based on the initial credit inquiry for each applicant. Highlighting this increase potential will help mortgage lenders better understand how they may be able to help their broader applicant pool qualify for a mortgage program, or a lower interest rate based upon the applicant’s mid-score.

Expanding Access to Homeownership

To see a detailed breakdown with month-over-month comparisons, download the full MCPI here.

Increased Purchasing Power

To see a detailed breakdown with month-over-month comparisons, download the full MCPI here.

_______

The mid-scores analyzed are the FICO® scores requested by a lender and reported by one of the credit bureaus or credit reporting agencies. FICO® is a registered trademark of Fair Isaac Corporation (FICO). CreditXpert is not affiliated with or endorsed by FICO or any of the credit bureaus or credit reporting agencies. CreditXpert trademarks used herein are trademarks or registered trademarks of CreditXpert, Inc. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder or their product or brand. Other product and company names mentioned herein are the property of their respective owners.

[1] CreditXpert action plans are tools meant to educate mortgage professionals and prospective consumer loan applicants, and are not furnished for the purpose of improving an applicant’s credit record, credit history or credit rating, or removing or modifying adverse, inaccurate, fraudulent, or other information in an applicant’s credit record. CreditXpert is not a credit counseling, credit repair, or credit reporting agency. Credit scores and score changes from CreditXpert are estimates, and will likely differ from credit score information used by mortgage professionals to assess loan eligibility. CreditXpert does not guarantee that scores from any other company will change by the same amount, in the same way, or at all.

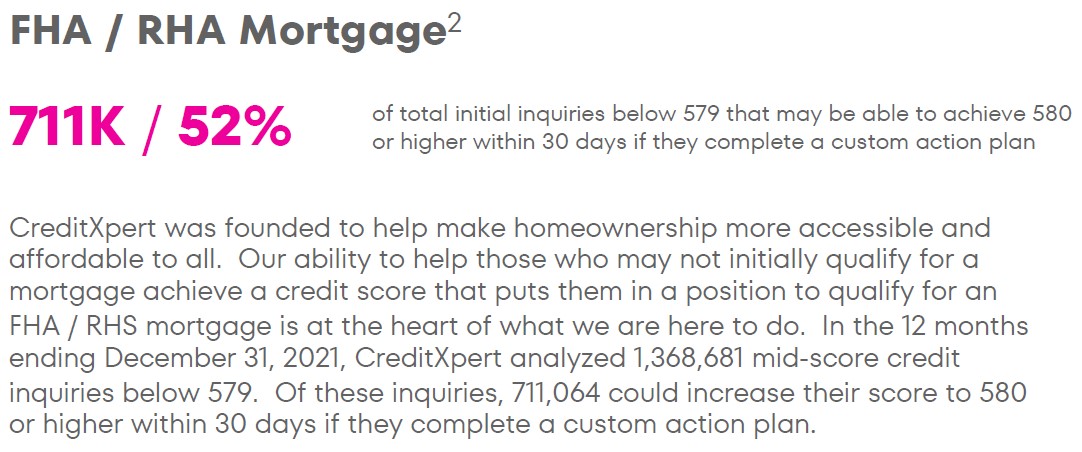

[2] A Federal Housing Administration (FHA) Loan is a home mortgage that is insured by the government and issued by a bank or other lender that is approved by the agency. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores, typically 580, than is usually required. The FHA loan is designed to help low- to moderate-income families attain homeownership. They are particularly popular with first-time homebuyers.

The Rural Housing Service (RHS) provides loans directly to low-income borrowers in rural areas and guarantees loans provided by approved lenders. An RHS loan can help a borrower who otherwise might not qualify for a traditional mortgage because of low income or bad credit to buy a home in an approved rural area.

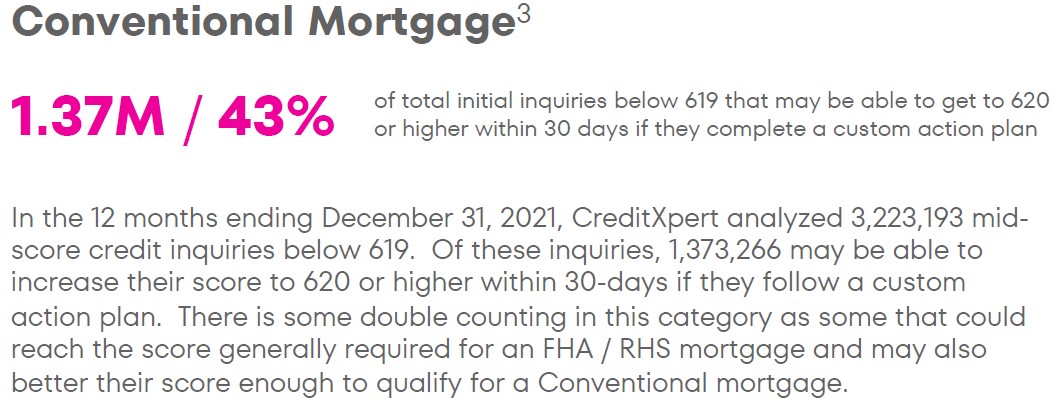

[3] A Conventional Mortgage is any type of home buyer’s loan that is not offered or secured by a government entity. Instead, conventional mortgages are available through private lenders, such as banks, credit unions, and mortgage companies. However, some conventional mortgages can be guaranteed by two government-sponsored enterprises; the Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac). Conventional loans typically require a minimum credit score of 620. Loan size must be equal to or less than $647,200 or $970,800 in high-cost areas for a single-family home.

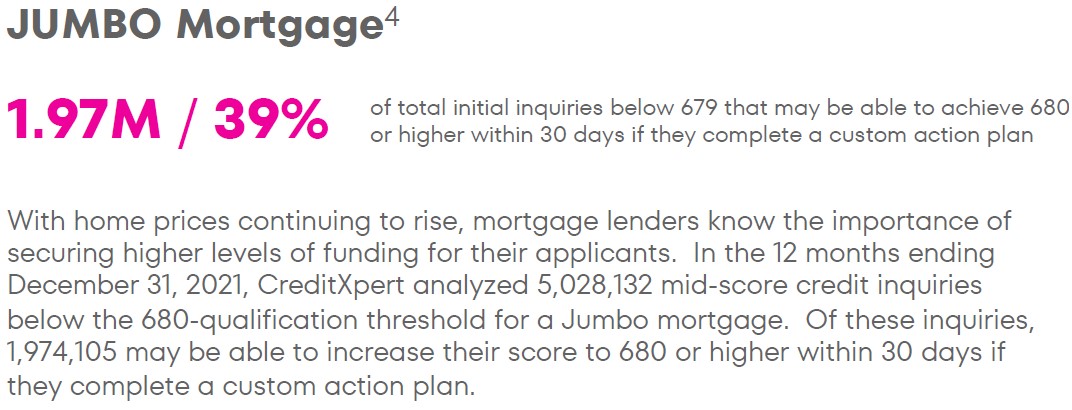

[4] A Jumbo Loan is a non-conforming mortgage loan that exceeds the limits set by the Federal Housing Finance Agency (FHFA). Jumbo loans are non-conforming loans as they cannot be purchased, guaranteed, or securitized by Fannie Mae or Freddie Mac. The main advantage of a jumbo loan is that it lets you borrow more than the limits imposed by Fannie and Freddie. Jumbo loans typically require a minimum credit score of between 680 and 700 depending on individual lender guidelines.

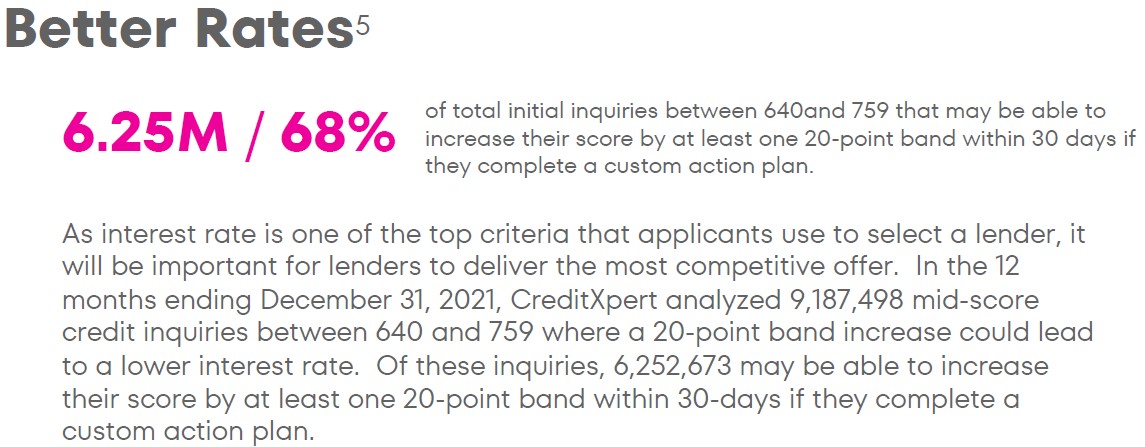

[5] According to the Loan Level Price Adjustment tables published by Fannie Mae and Freddie Mac, those with credit scores between 640 and 759 could potentially qualify for a better rate if they increase their score by at least one 20-point band. The Loan Level Price Adjustments are guidelines that are subject to individual lender pricing policies.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

MCPI is a monthly study of mid-score mortgage credit inquiries by 20-point bands that serves as an indicator of changes in mortgage demand and reveals affordable housing and other lending opportunities.