The browser you are using is not supported. Please consider using a modern browser.

What insights can the negative factors provide about the score?

Why isn’t my credit score higher?

Why is my credit score so different across the bureaus?

Why did my credit score change so much?

These are some of the common questions clients ask mortgage professionals. The answers may be hidden in plain sight: the negative factors (or adverse action codes) listed near the score on the credit report.

These negative factors don’t always show the same information – although it may seem that way sometimes. However, with additional background information on how the negative factors are presented, we think you’ll find them pretty helpful.

These negative factors don’t always show the same information – although it may seem that way sometimes. However, with additional background information on how the negative factors are presented, we think you’ll find them pretty helpful.

Why isn’t the score higher?

Having a credit score over 800 is excellent, but we know some clients wonder why it’s not even higher. Looking at the negative factors, which are always listed in order of their impact, can help answer this question. This means that the first listed factor for each bureau is having the greatest negative impact (and the second has the next largest impact, etc.). Even a customer with a great credit score will have negative factors listed, so this information helps explain why a score isn’t “perfect”.

Why is the score so different across the bureaus?

Scoring models are unique to each bureau, as is the information being reported. Small differences in the credit scores (up to 30 points or so) are not uncommon. However, if there is a significant difference between two bureaus, comparing the negative factors of each may reveal which items aren’t being reported in the same way.

Why did the score change so much?

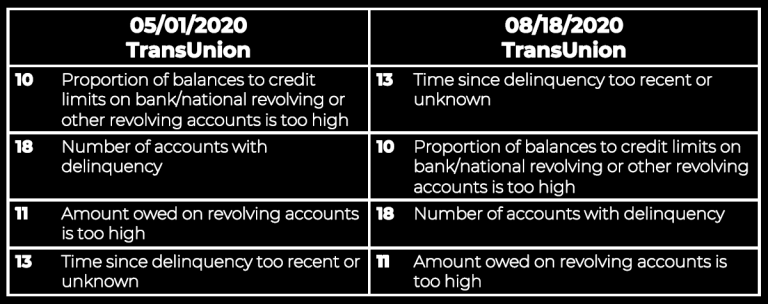

If a bureau’s score changed significantly from one credit pull to the next, comparing the negative factors can shed light on the cause. Perhaps the reports list the same factors but in a different order. For example, in the below image, “Time since delinquency too recent or unknown” went from being the fourth highest negative factor to the first. You can conclude that this factor is now having a greater negative impact on the score. In this scenario, it would likely mean that a new (or more recent) “late” is being reported to this bureau.

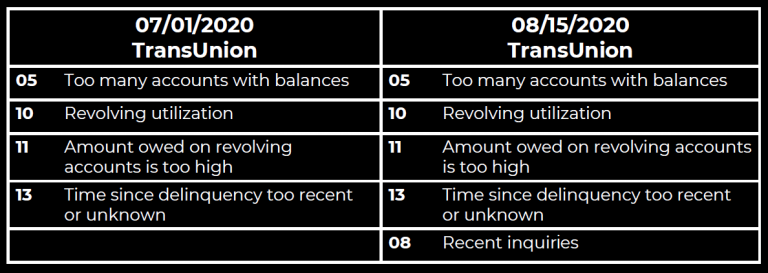

Another situation you might encounter is that the second report looks the same, except “inquiries” are now mentioned in the list (see below image for another example). Due to FACTA (Fair and Accurate Credit Transactions Act), FICO must communicate when inquiries are affecting the score, even if it’s just by one point. If inquiries are having an impact, but not enough to be one of the top four negative factors, it will appear as a fifth factor. In this example, you can see that the initial credit pull was unaffected by inquiries. However, in the next credit pull, “Recent inquiries” are now impacting the score (note: “inquiries” may be listed as plural in the negative factors even if there is only one).

Watch our “Xpert Insights” video below to see more examples and get more details about how the negative factors can provide a window into the credit score. If you learned something new, share our blog post and video with your colleagues so they can as well.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

Did you ever wonder why the credit score is what it is? The negative factors can give you valuable insights. Our product support manager Rosa Mumm helps you decipher them in our new “Xpert Insights” video.