The browser you are using is not supported. Please consider using a modern browser.

Mortgage Affordability Trends — What to Expect Next…

What is mortgage affordability?

Affordability, in this context, is the simple measure showing the median home prices as a multiple of median household income. Simply stated, housing affordability is a measure of, whether a typical family earns enough income to qualify for a mortgage loan on a typical home at the national and regional levels based on the most recent price and income data.

It’s an issue that isn’t going away and affects every potential homebuyer, regardless of their credit score.

What’s going to happen to the housing market during the next three years?

When considering the 2023 – 2025 mortgage market, we must take a step back and appreciate the uniqueness of the situation. Like many market segments, though perhaps more so in mortgage lending due to its extreme volume volatility, it’s difficult to get any sense of the future by looking at the past. No two periods of time compare very easily, nor do they give us much help determining what’s ahead.

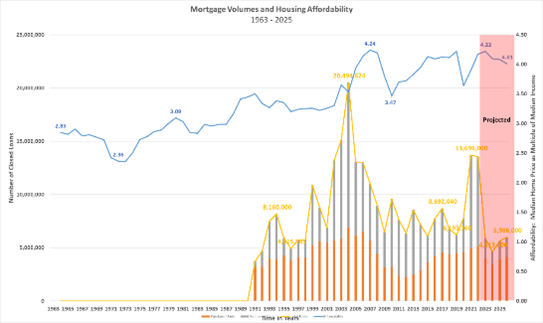

That said, we’ve tried our best. Let’s look at Graph I, it provides a look at historic purchase, refinance and total unit volumes from 1990 forward. One precaution, while the unit volumes prior to 2014 are directionally correct, please view them as exactly that. We used median sales price versus total dollars lent to reach a unit volume 1990 through 2013. The yellow line is total volume.

Interestingly, the market has seen higher unit volumes than 2020 and 2021 back in the wild west days preceding the housing crisis – the cause of the subsequent collapse of volume post-2006 is well-known and nothing like today’s situation.

The blue line is a different way to look at mortgage affordability. It’s a simple measure showing the median home price as a multiple of median household income. While high now, it was high immediately preceding the housing crisis. Rates and housing price corrections brought it down in the 20-teens. Something similar will likely happen in 2023 through 2025, though as the graph shows, the multiple is unlikely to decrease as much as it did then. Restating the point: affordability is an issue that is not going away, and it affects every potential homebuyer, regardless of their credit score. The other point is when the multiple is high, mortgage volumes drop.

Graph I

Mortgage Volumes, in units and Affordability

Will the refinance market return soon?

Lower rates that lead to a refinance boom is what brought the market back post-housing crisis. Rates will decrease over the next two to four years, they will not likely drop far enough to spark another major refinance boom. Refinance as a share of total market volume will increase, though not to the levels seen in the past couple of years.

What is the financial state of the mortgage industry?

Cost to close (the cost to produce a loan) is at an all-time high of $11,016 per loan. Productivity is at an all-time low of 1.5 close loans per employee per month. Graph II provides a look back and a look forward at these two measures. Note here, too, that the look forward are my estimates; there is no other industry source for this information. Here, though, historical performance is a relatively good indicator of future results.

Graph II

Cost-to-Close and Productivity

Generally speaking, the wider the gap between the lines, the tougher the economics of the mortgage industry. Pre-pandemic lenders were stuck in the low productivity / high cost-to-close doldrums, which could happen over the next 5 or more years; this is not an industry that typically manages itself well. The punchlines here are two-fold. First, lenders will think first of cost rather than of revenue. Said another way, this makes the sales cycle challenging. Second, every $1,000 in cost-to-close equals about 10 basis points in mortgage rate to the consumer. Rates are at least 30 basis points higher than they ought to be at present due to the high cost-to-close. This adversely impacts affordability.

How can CreditXpert help mortgage affordability?

In closing, here’s how CreditXpert could help remedy the housing affordability crisis.

- Help lower the interest rate borrowers pay, and bring more borrowers to the closing table

- We can help anyone, anywhere on the credit spectrum

- Provides borrowers with a custom and clear plan of action to improve their credit score

To learn more about how CreditXpert’s Platform can help, sign up for an upcoming live demo webinar.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

More and more agents are learning that affordability is a function, in part, of the borrower’s credit score. While things like interest rates, construction costs and housing inventory are out of our control, prospective home buyers CAN do something about their credit scores.