The browser you are using is not supported. Please consider using a modern browser.

May MCPI Has Been Released – Overall Demand Lower Than April

What’s the Mortgage Credit Potential Index

CreditXpert analyzes millions of mortgage credit inquiries each month. We use our proprietary predictive analytics engine to help thousands of mortgage loan originators highlight the potential score increase their applicants may be able to achieve within 30 days by completing a custom action plan.

The Mortgage Credit Potential Index™ (MCPI) is a unique, monthly supply-side view of mid-score mortgage inquiries. The MCPI also highlights the percentage of inquiries that may be able to increase their initial score by at least 20-points within 30 days by completing a custom action plan.

Demand Overview

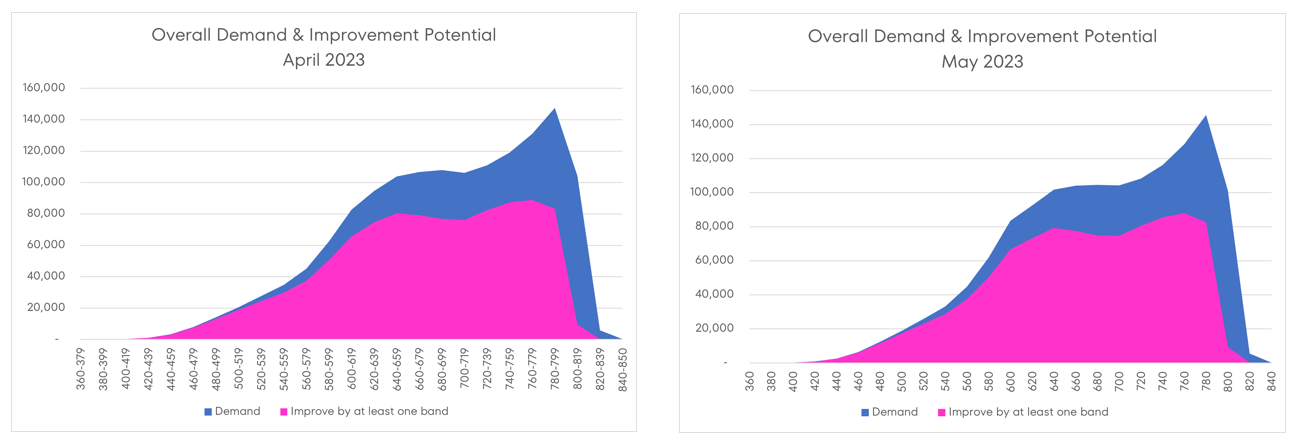

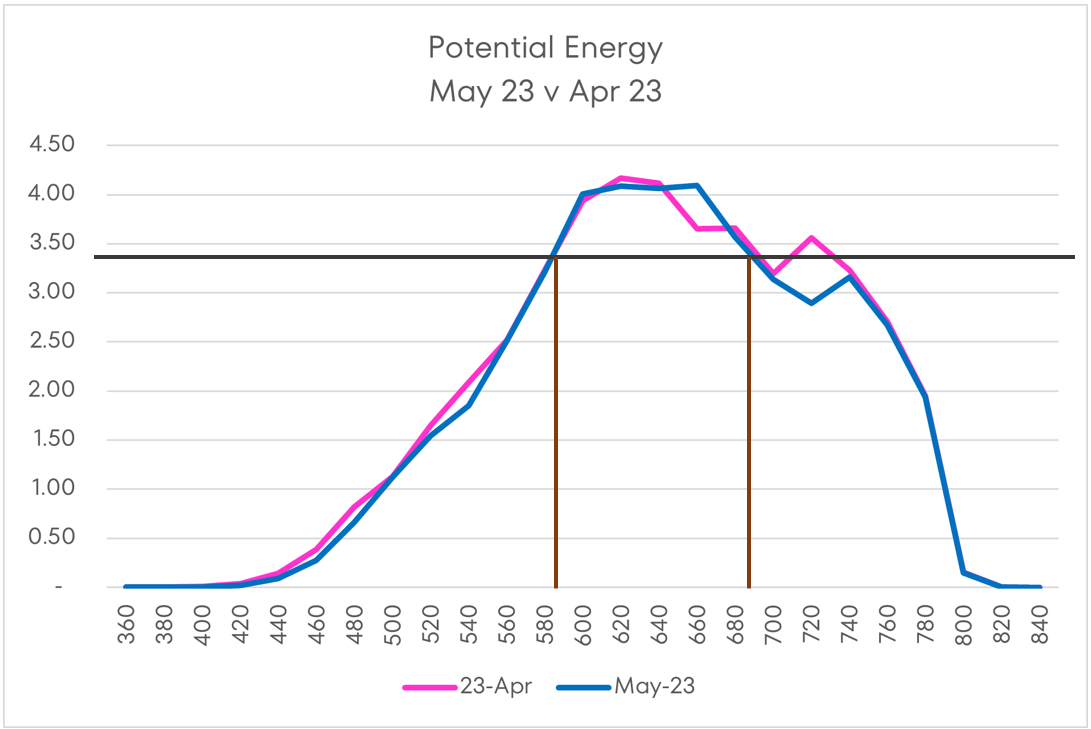

Overall demand is a little lower in May v April, yet the pattern is essentially the same, meaning the borrowers in the market have essentially the same credit profiles month over month. Consistency is good. The decrease in volume is likely to be expected given interest rates and the uncertainty of the debt ceiling, which has now been settled. Credit Potential, in terms of Zone of Opportunity, is also about the same.

What’s the Zone of Opportunity

CreditXpert’s ‘Zone of Opportunity’ highlights, on a monthly basis, those borrowers whose credit scores are most in the market and have the most potential to improve. Knowing this shows the successful lender where to concentrate their efforts to close more loans, and do so profitably.

There’s the same oddness happening between 700 and 750 credit score bands, same as compared to the last couple months. We’re seeing a peak in April and a dip in May. Then there’s the extension of peak potential out toward the 680 range — which makes it clear that there remains a great deal of borrowing opportunity in the 580 to 690 credit score range, and that’s been relatively consistent too.

With consistency in overall demand, consistency in the ratio of those credit bands that can improve by at least one band (69%) and in those ranges with the greatest potential we’re getting a clear picture of the post-pandemic potential borrower. Those in the market during the pandemic were of an entirely different credit score make-up. What we see now is the borrower of the mid-2020’s emerging.

To download the full Mortgage Credit Potential Index and get more granular data, click here.

Related Credit Insights

MCPI is a monthly study of mid-score mortgage credit inquiries by 20-point bands that serves as an indicator of changes in mortgage demand and reveals affordable housing and other lending opportunities.

The MCPI is a monthly reporting of mortgage credit inquiries analyzed by CreditXpert's predictive analytics platform, which highlights the volume of mid-score mortgage credit inquiries by 20-point credit bands between 360 and 850. When compared to prior months and years, the MCPI serves as an indicator of changes in query volume.