The browser you are using is not supported. Please consider using a modern browser.

How to Grow Your Business With the New Mortgage Credit Potential Index

What’s the MCPI?

MCPI is a monthly study of mid-score mortgage credit inquiries by 20-point band that serves as an indicator of changes in mortgage demand across the consumer credit spectrum and reveals affordable housing and other lending opportunities. It was designed to help lenders see how shifts in volume and applicant credit potential should shape their lending operations to reduce credit fallout in an increasingly competitive mortgage market. It helps lenders craft strategies that will expand their addressable audience and offer more competitive offers for an increasingly savvy consumer.

What’s Inside?

Inside each MCPI, here’s what you can expect:

Credit Potential Review

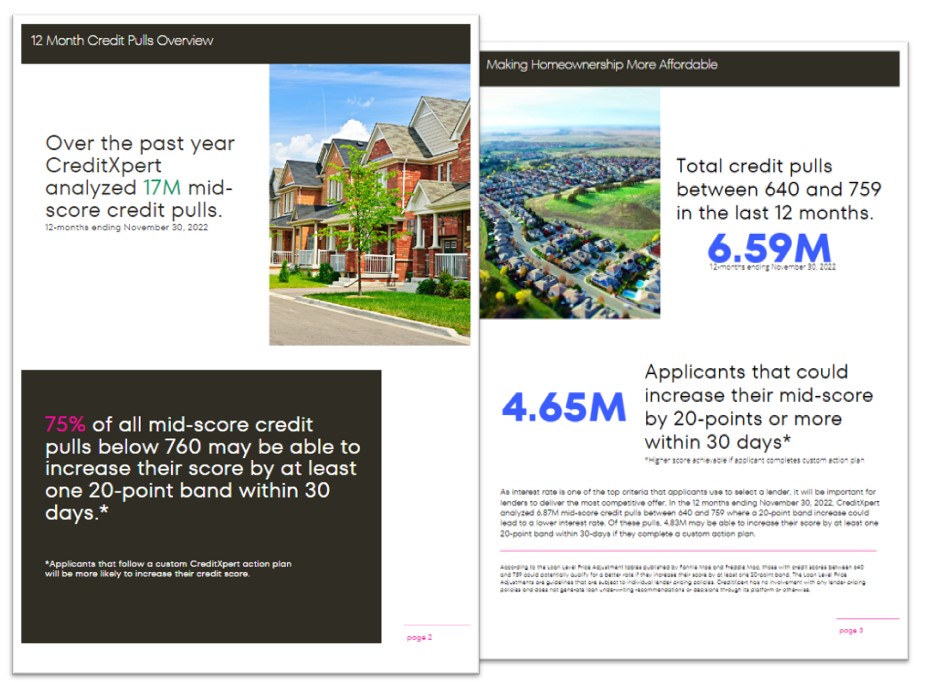

- 12 Month Credit Pulls Overview gives the number of credit pulls CreditXpert analyzed during the last 12 months. Additionally, we look at Percentage of Mid-Score Credit Pulls Below 760 that may be able to increase their score by at least 20 points in 30 days.*

- Making Homeownership More Affordable dives into the total number of credit pulls between 640 and 759 in the last 12 months. Then, from that total we calculate How Many Applicants Could Increase Their Credit Mid-Score by 20 points or more within 30 days. *

*Applicants that follow a custom CreditXpert action plan will be more likely to increase their credit score.

Market Data Dive

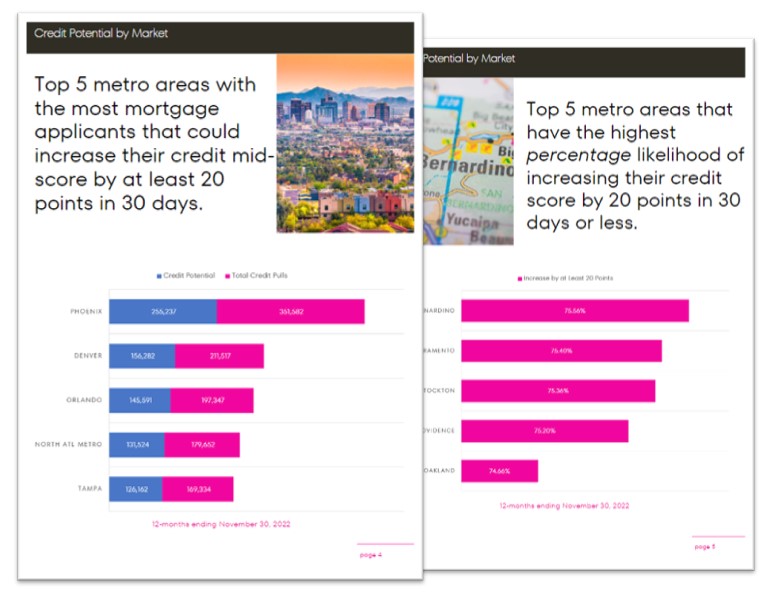

- Credit Potential by Market provides data that shows which metro areas have the most applicants that could increase their credit mid-score by at least 20 points in 30 days or less.*

- Credit Potential by Market (2) shows the top 5 metro areas that have the highest percentage likelihood, of those applying for a mortgage, to increase their credit score by 20 points in 30 days or less.*

*Applicants that follow a custom CreditXpert action plan will be more likely to increase their credit score.

Our Take On Market Conditions

There are a number of cities around the United States that are home to high numbers of potential home buyers who could actually qualify for a more expensive home than their current credit scores suggest. That’s one of the insights from the most recent Mortgage Credit Potential Index (MCPI) from CreditXpert, the predictive credit score platform that helps lenders expand homeownership opportunities.

Topping the list of cities with the most potential home buyers who could raise their credit score is Phoenix, followed closely by Denver and Orlando. Tampa, San Bernardino, Charlotte, Atlanta and Nashville also made the short list.

“Our data for September, October and November revealed some very interesting trends that could point to new business for lenders this year,” said CreditXpert Vice President of Marketing, Mike Darne. “Certain cities stood out for the number of home buyers who could raise their credit scores in as little as 30 days and either qualify for a larger new home or qualify for a lower rate on a new mortgage loan.”

After studying the data from millions of credit reports, it has become abundantly clear that many would-be home buyers have no idea how fast and easy it would be for them to raise their credit score and qualify for a more affordable mortgage.

“Our data show that millions of Americans could raise their scores within 30 days by only taking a few easy steps. Lenders can show them how with a one-page report. Those that do will win more new business this year,” Darne said.

The MCPI is your roadmap to more mortgage business because it demonstrates where demand is currently highest and shows the full scope of credit potential for borrowers, no matter their credit score. Click to download the November MCPI.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

Uncommon knowledge: Mortgage and consumer credit scores are quite different. What's different? How are each calculated? Why are there two scores?