The browser you are using is not supported. Please consider using a modern browser.

How to Overcome High Interest Rates by Bettering your Mortgage Credit Score

Did you know the first thing mortgage lenders look at is your mortgage credit score? When you apply for a mortgage, they need to know, do you have a good credit history? This applies to first-time homebuyers, homeowners refinancing, or those buying a subsequent home.

Now, not every mortgage program requires ‘great’ credit. That much is true. However, a higher credit score means lower interest rates and better terms which means a more affordable mortgage. In today’s economy, you need to do everything possible to keep your interest rate down.

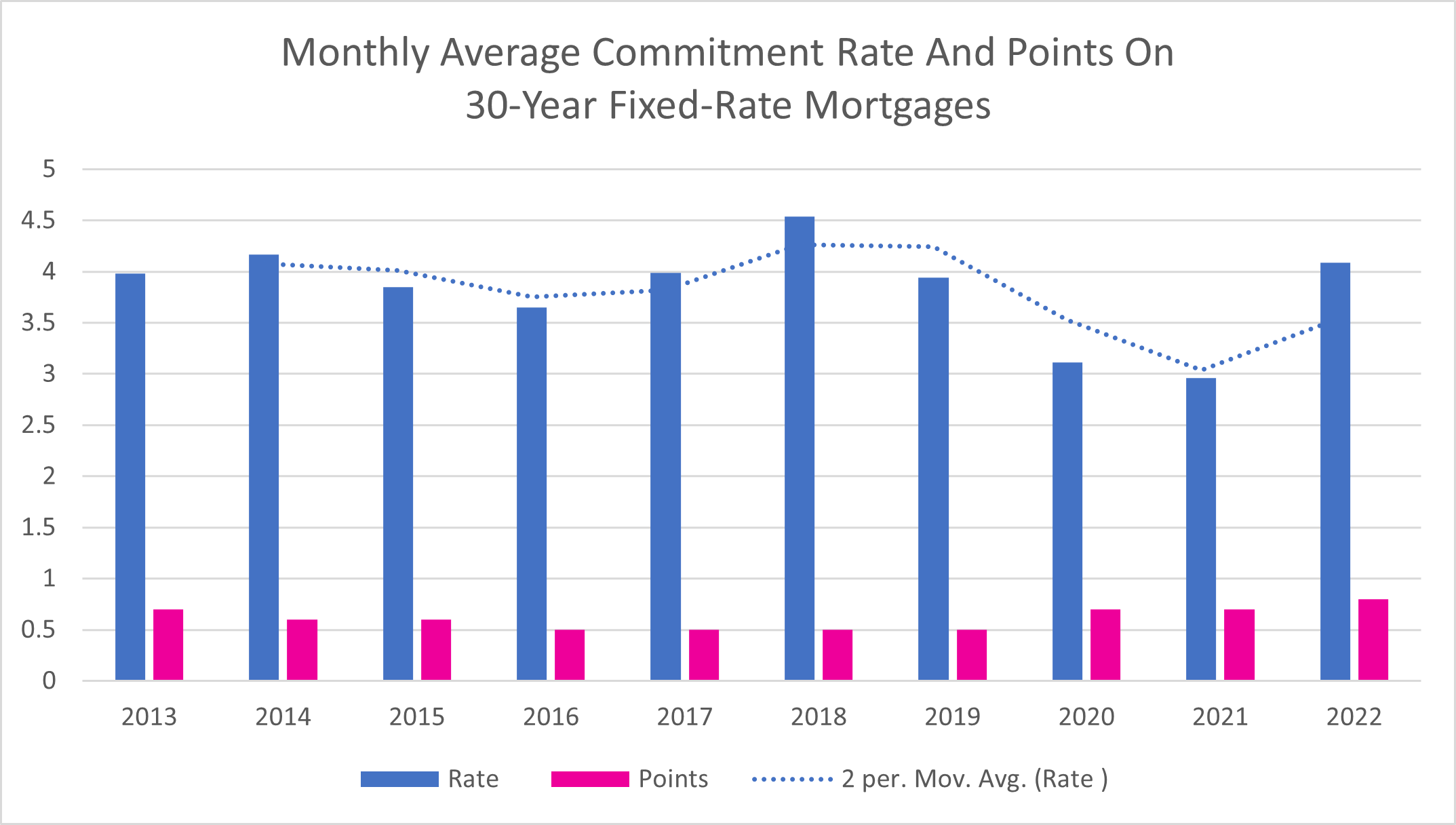

In the heart of the pandemic, we saw the lowest interest rates we’ve seen in decades, but fast forward to today and we’re seeing much higher rates that could affect affordability. In fact, today’s rates are making potential homebuyers wait because they can’t afford the payment.

Source: FreddieMac, 30-Year Fixed Rate Mortgages Since 1971

Fortunately, there are ways to lower your interest rate and it starts by bettering your mortgage credit score.

It’s not as hard as it sounds, but first, you should understand why a high credit score is so important.

A High Credit Score Means you Pay your Debts on Time

Let’s face it, no one likes a borrower that pays their debts back slowly or not at all. That’s why your payment history is the largest part of your credit score. If you pay your debts back slowly, mortgage lenders don’t want to take the risk.

If they do, they’ll make up for the risk by charging much higher rates. The difference between a 4% rate and a 5% rate on a $100,000 30-year loan is $59 a month. That may not sound like much, but over a year that’s $708, and over a 30-year term, that’s $21,240. There are much better things you could do with $21,000 than pay it to interest, right?

A High Mortgage Credit Score Means you Don’t Overextend your Credit

Your credit lines aren’t meant to be maxed out. In fact, the credit bureaus penalize you if you use up over 30% of your credit line and don’t pay it off in full. You could charge more than 30% of your credit line and pay the balance before the due date and it won’t affect your credit score.

But, if you carry a balance larger than 30% of your credit line ($300 for every $1,000 credit line), it will hurt your credit score. Paying those balances down will help your score increase and allow lenders to give you a lower interest rate.

A High Credit Score Means you Have a Good Mix of Credit

Your credit mix also plays an important role in your mortgage credit score. For example, a borrower with all credit cards (revolving debt) and no installment debt (fixed rate loans), doesn’t prove they can handle a loan like a mortgage. You only show that you can rack up credit card debt (and hopefully pay it off).

If you have a mix of both revolving and installment debt, you show that you can handle both types of accounts.

Since a mortgage can last for 15 – 30 years, chances are you’ll have credit cards and other loans within that time. Showing that you have a positive history of handling both types of debt can work in your favor, helping you get a lower interest rate.

Why Lenders Base your Interest Rate on your Credit Score

Your credit score is the number one factor lenders have to determine your risk of default. A low credit score shows that you’ve handled your credit poorly in the past and aren’t a good risk for a mortgage.

If they do approve you, they’ll make up for the risk of default by charging a higher interest rate. This allows lenders to make more money while you make your payments in the event that you default.

Showing lenders you are a good risk is the key to getting the lowest interest rate possible in today’s high interest rate environment. While your credit score is just one factor, it’s one of the largest affecting your interest rates.

Increase your Mortgage Credit Score Before Applying for a Mortgage

Saving money, having a stable job, and keeping your debts under control are all great steps before you apply for a mortgage, but the primary step should be to increase your mortgage credit score.

It’s the first factor lenders will look at and the first data point they’ll use to say ‘yes’ or ‘no’ to your application. Improving your credit score isn’t as hard as it seems. With a few simple steps, you could be well on your way to an approved application with the most attractive mortgage interest rate.

Related Credit Insights

The enterprise-ready SaaS platform helps mortgage lenders attract more leads, make better offers and close more loans.

Uncommon knowledge: Mortgage and consumer credit scores are quite different. What's different? How are each calculated? Why are there two scores?