The browser you are using is not supported. Please consider using a modern browser.

Grow production profit. Compete for EVERY applicant.

One of the best ways to increase profitability is to ensure EVERY mortgage applicant has the highest credit score possible. Our predictive analytics engine eliminates the guesswork by identifying the credit potential for EVERY applicant. Turn that potential into a higher score with a 30 day action plan.

Used by the Nation's top mortgage lenders

Our proprietary algorithms have analyzed more than 750 million credit records. This eliminates guesswork and keeps your focus on finding potential opportunities for applicants to secure the best rates and terms.

Tools to help realize applicant potential

The next generation of credit potential is here.

Make better offers. Close more loans.

We’ve worked with innovative lenders to build a platform that utilizes credit to qualify more applicants, make better offers and close more loans. CreditXpert helps you increase transparency and help ensure that EVERY applicant has the opportunity to qualify for the best rate and terms.

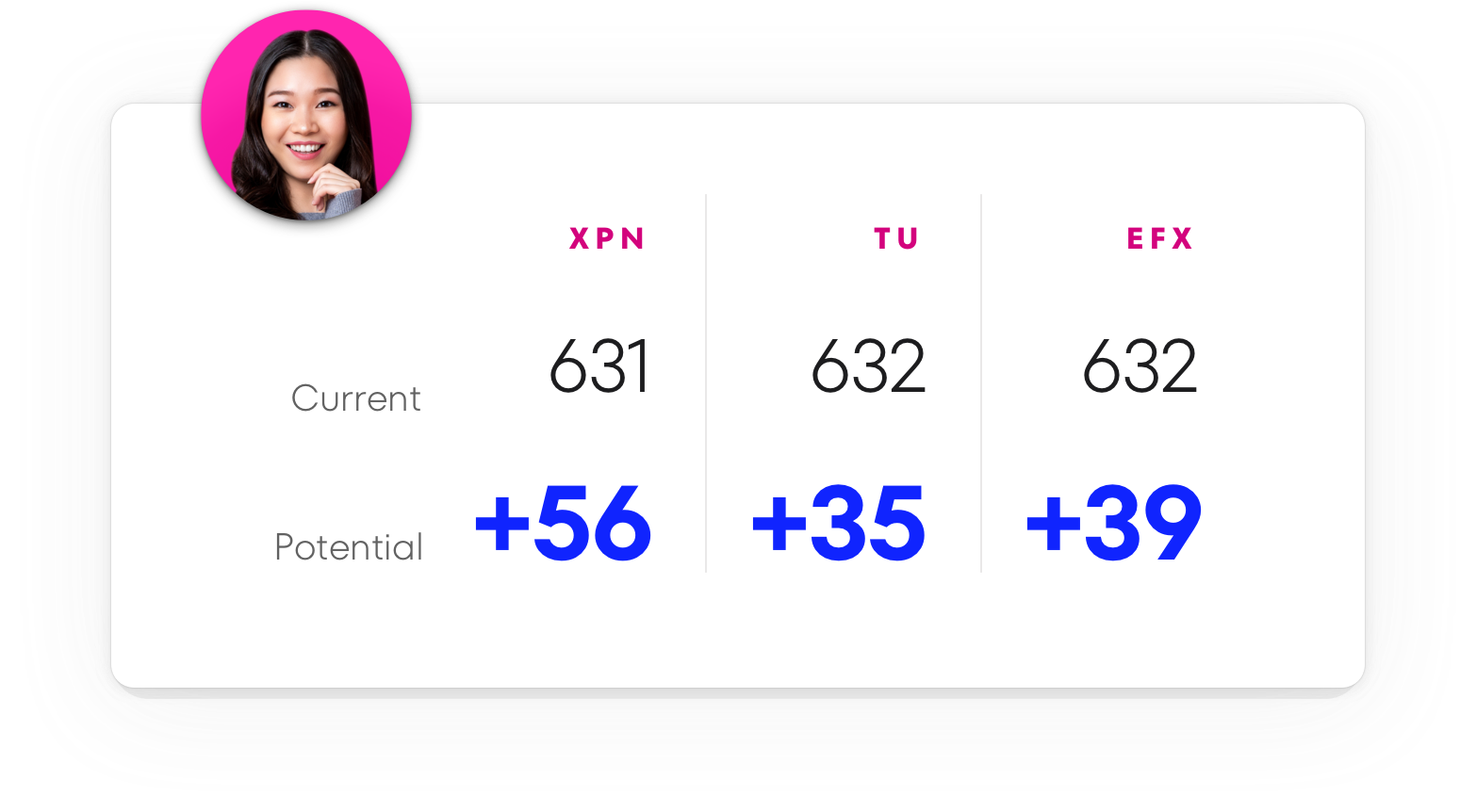

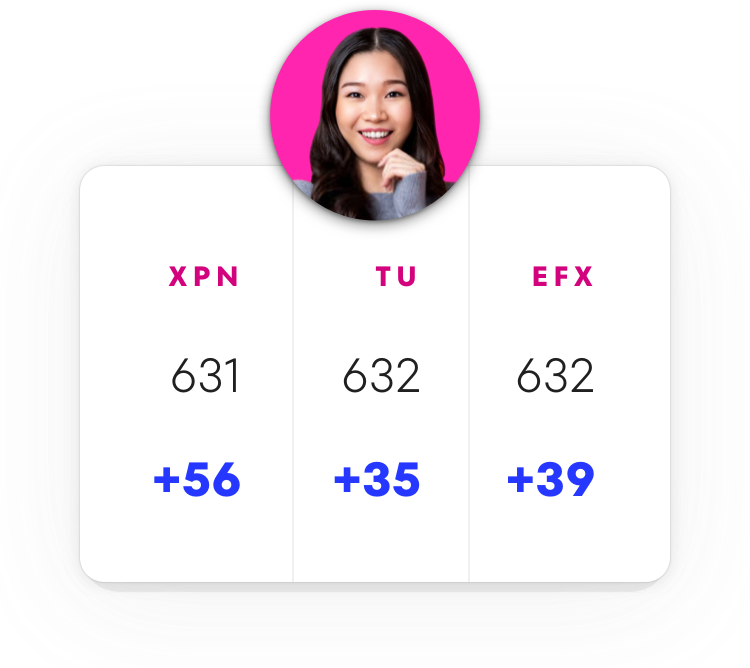

See instant Alerts on score potential.

Credit Assure™

Wondering if you are offering applicants the best rates and terms? Eliminate the guesswork. Quickly see the credit score potential for each bureau. Chances are Credit Assure is already there in your credit reports.

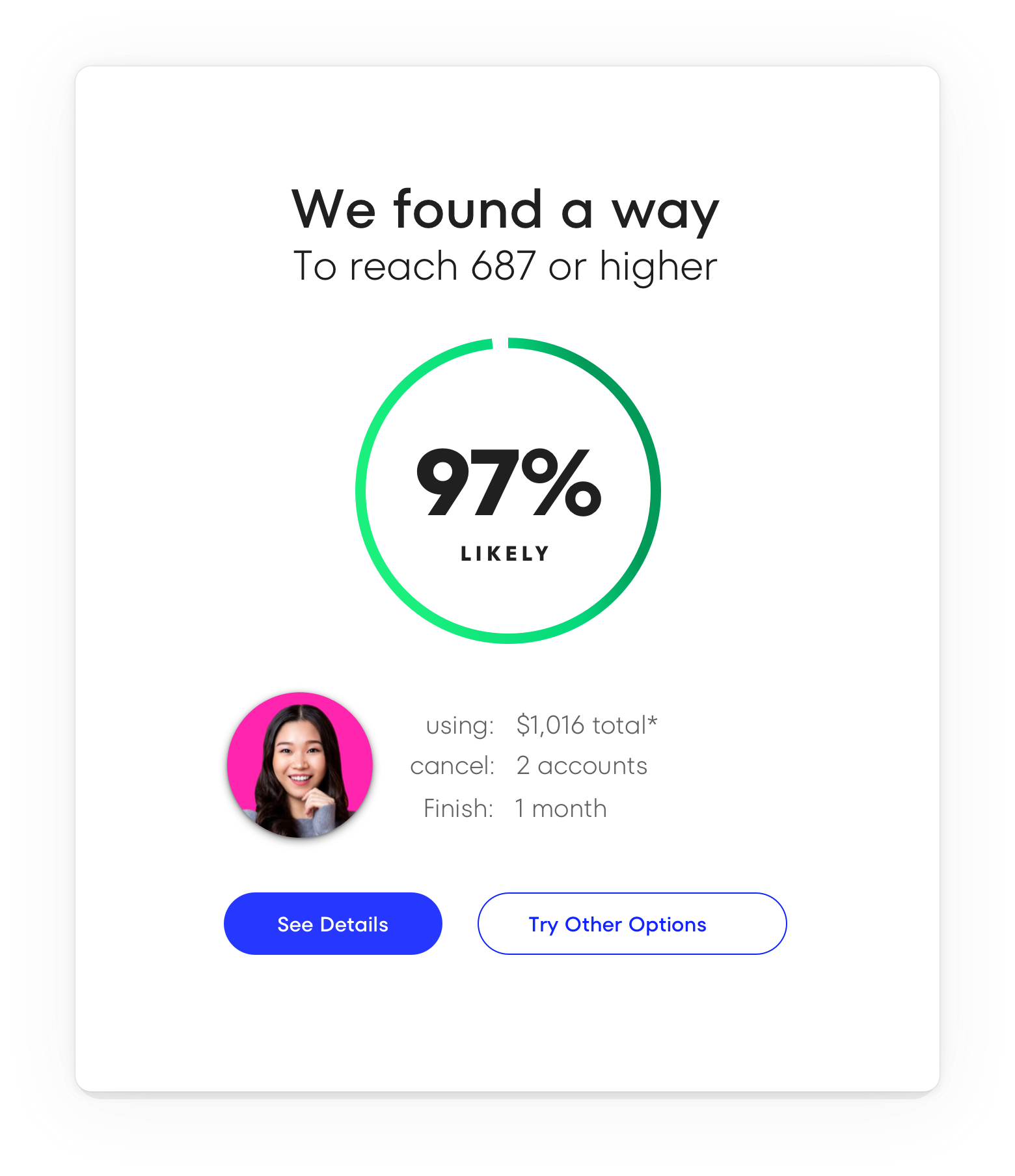

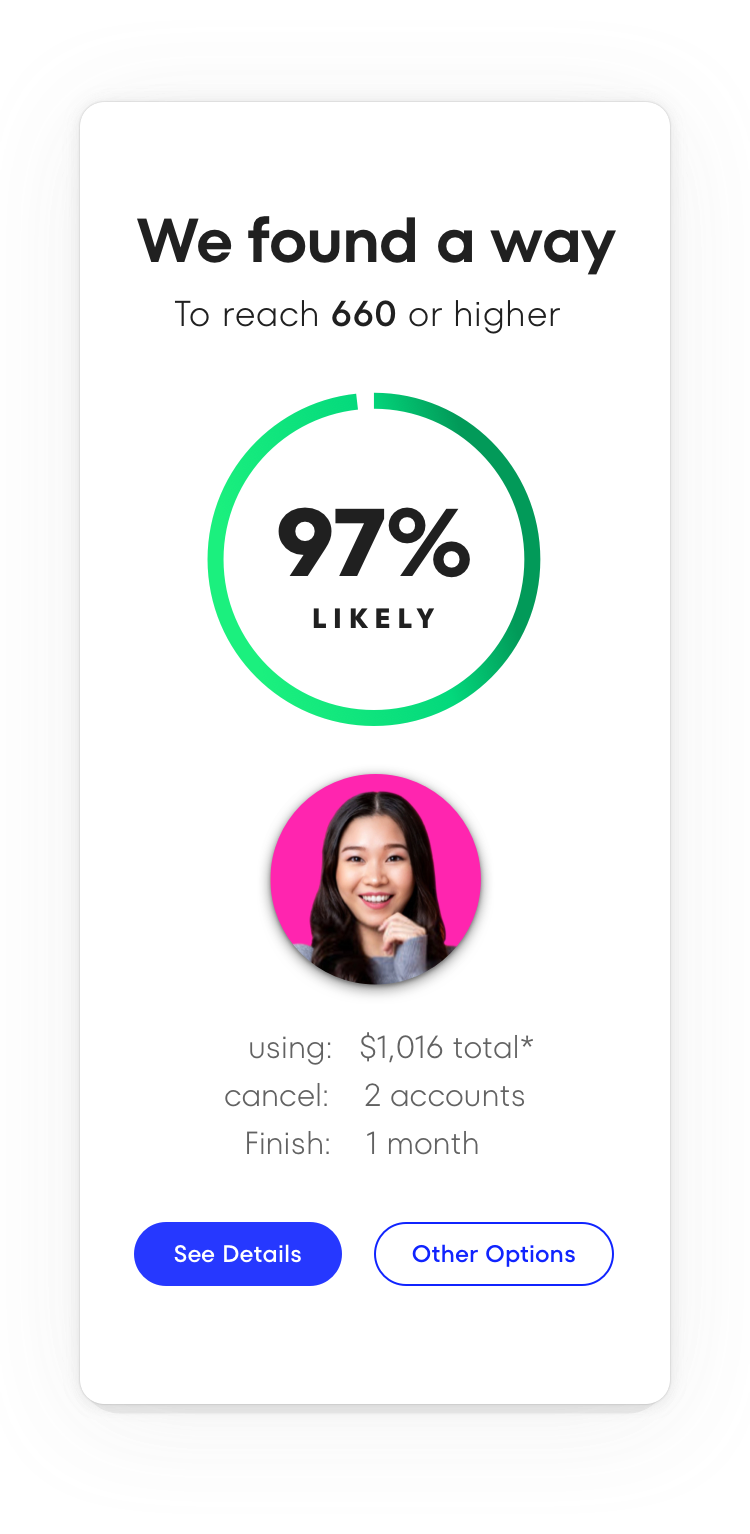

Create Automated Plans with one click.

Wayfinder™

Moving quickly with applicants is important. After training our algorithms against more than 750M credit inquiries, we know the fastest route to a target mid-score. With the click of a button, you’ll have an actionable plan within seconds.

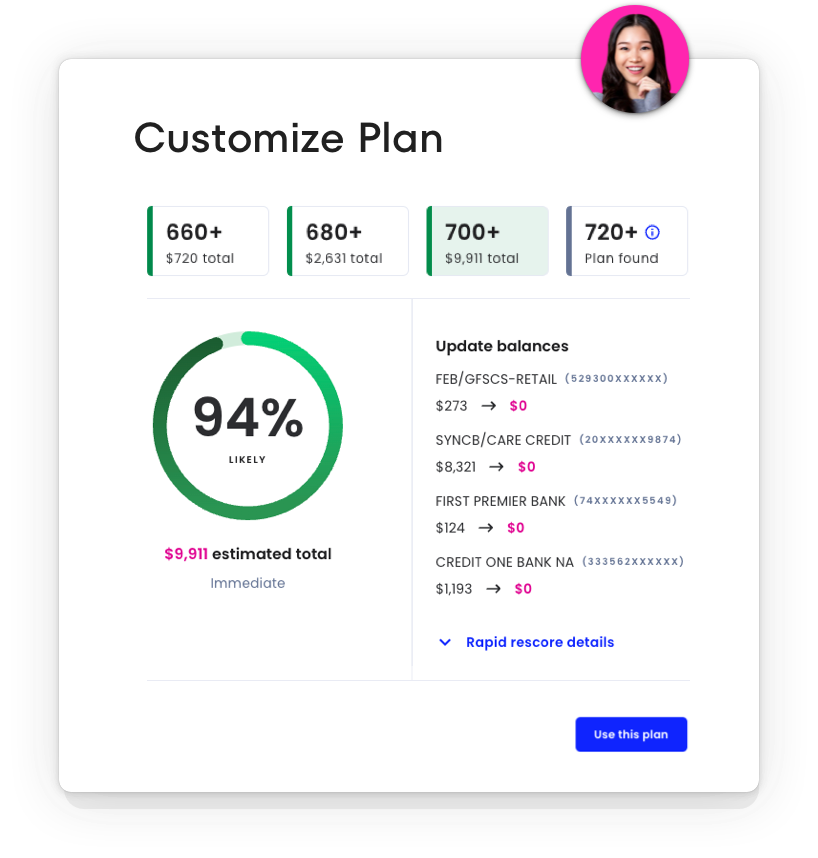

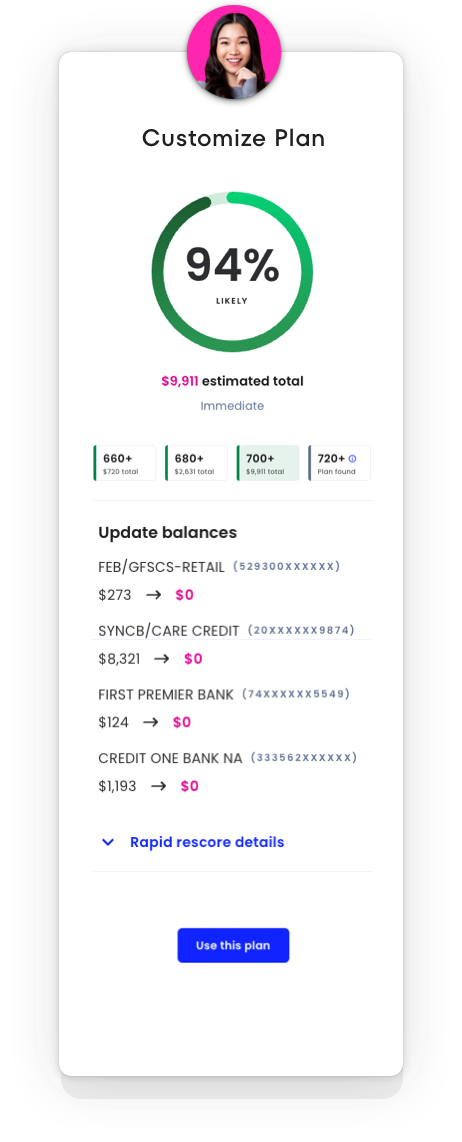

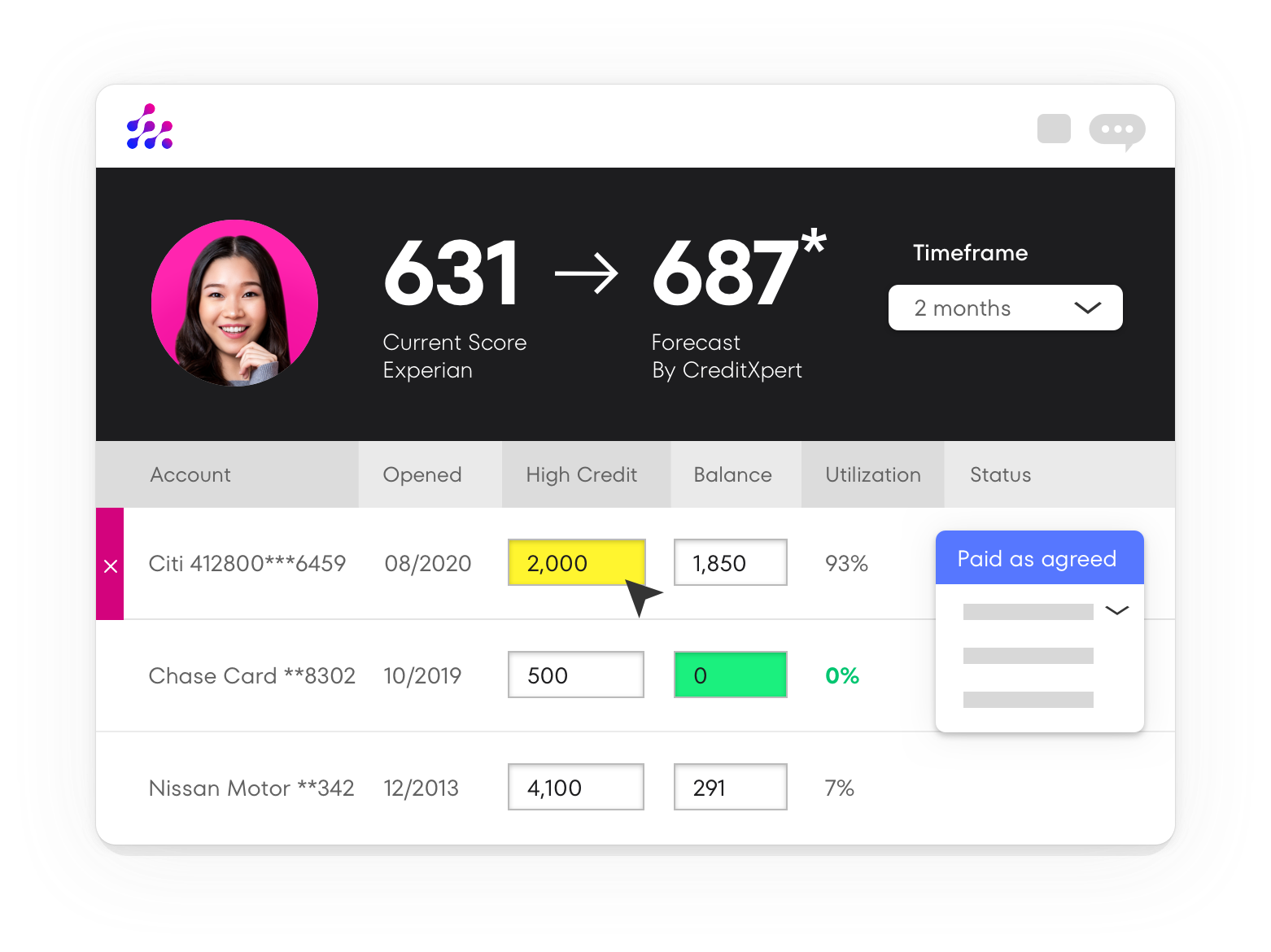

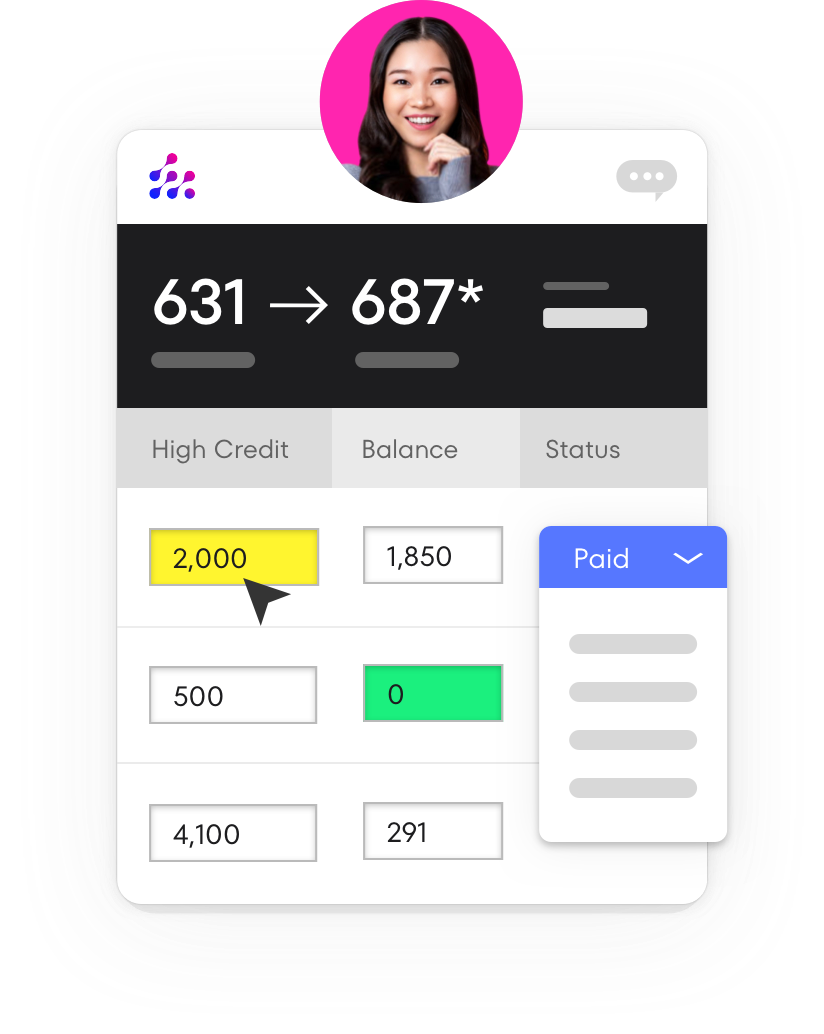

Model any scenario with our Simulation Engine.

What-If Simulator™

You now have access to the same simulation engine used by the Nation’s largest mortgage originators. Immediately see how increasing/decreasing balances, deleting accounts, closing accounts and more may impact an applicants’ score. You can even model scenarios over an extended period of time.

See where to find the CreditXpert platform.

Ready to dive in?

CreditXpert is offered through most credit report providers. Whether you purchase credit products from one or more providers, we’ll show you the easiest way to access our platform. Our client success team is also here to give you a tour and answer your questions.

See how others are using our platform.

Equity Mortgage Lending

Ken met with a client whose credit appeared to be exceptional. With interest rates at historic lows, the client wanted to refinance their mortgage. When Ken pulled his client’s credit score, they were both perplexed that it was 699 – relatively low given their overall credit standing. The client couldn’t figure out the reason their score wasn’t higher.

100+ Point Increase on Credit Score

HomeBridge Financial Services

Mark’s client needed to raise her credit score from 590 to 640 – just 50 points – to have a chance for an FHA loan. Most of her debt was due to credit card balances. Mark used CreditXpert® What-If Simulator™ to look for ways to pay down the debt that wouldn’t require a lot of funds.

50 Point Increase on Credit Score

PrimeLending

Rod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site.

18 Point Increase on Credit Score

Latest Credit Insights

Mortgage loan fallout—approved loans that fail to close—costs lenders money, time, and relationships. Causes range from credit score declines and rate lock expirations to appraisal issues and borrower disengagement. Targeted strategies like pre-closing credit monitoring, smart lock management, and strong borrower-agent engagement can reduce fallout, improving profitability, efficiency, and market reputation.

Loan officers often face declined applications from near-prime borrowers who narrowly miss credit score thresholds. Credit score optimization turns these declines into approvals by pinpointing high-impact actions that can boost scores within 30–60 days. Advanced tools offer borrower-specific recommendations, automate credit report analysis, simulate “what-if” scenarios, and integrate with credit bureaus — accelerating approvals while ensuring compliance. Choosing the right platform can increase funded loans, revenue, and borrower trust.

Mortgage conversion rates tell the real story of a lender's performance — and the gap between average and top performers often comes down to what happens after a rough application. Many credit-related declines involve borrowers who are surprisingly close to approval. With the right guidance and credit optimization tools, those near-misses become closed loans. The difference isn't more leads. It's doing more with the pipeline you already have.