The browser you are using is not supported. Please consider using a modern browser.

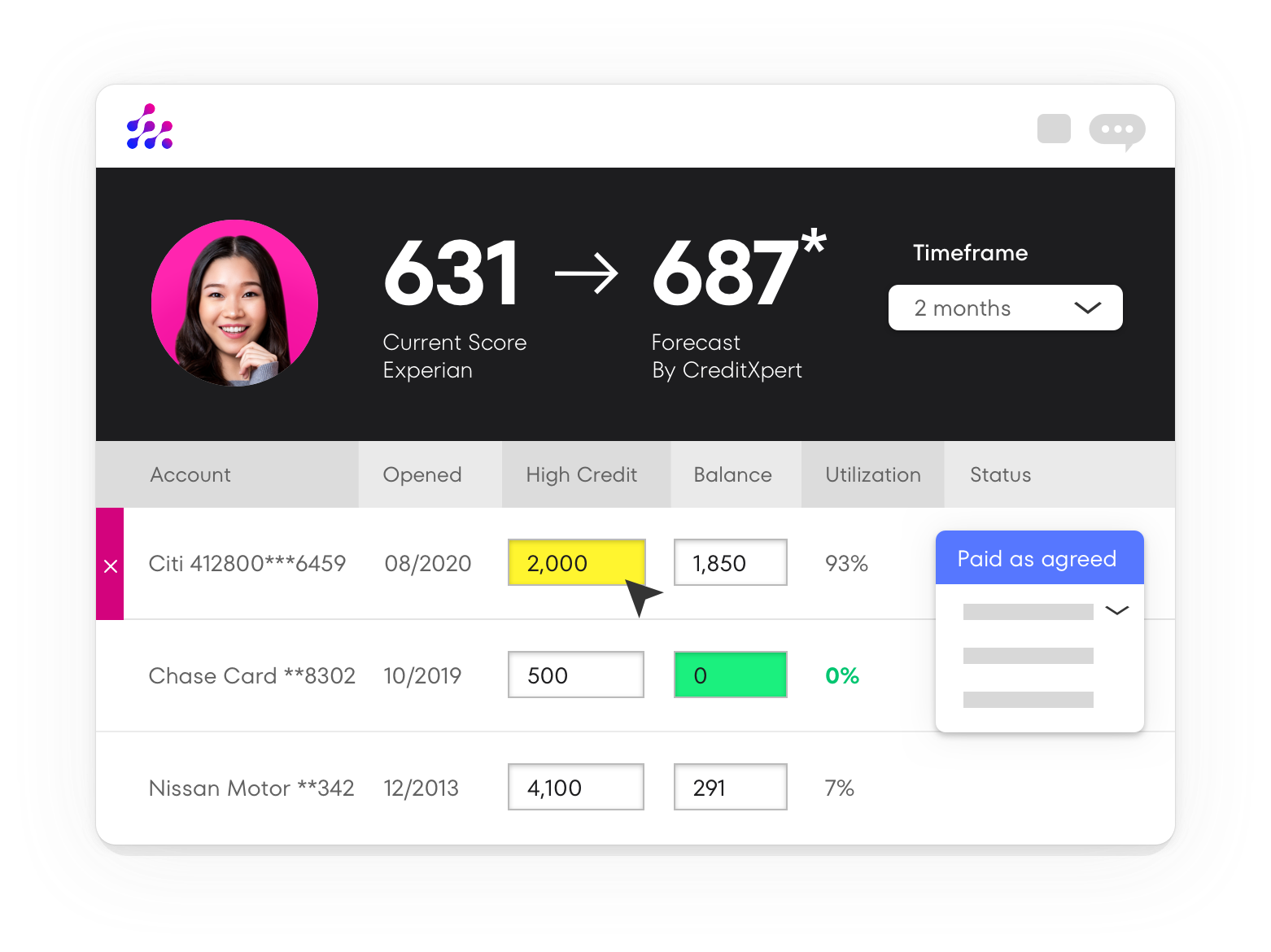

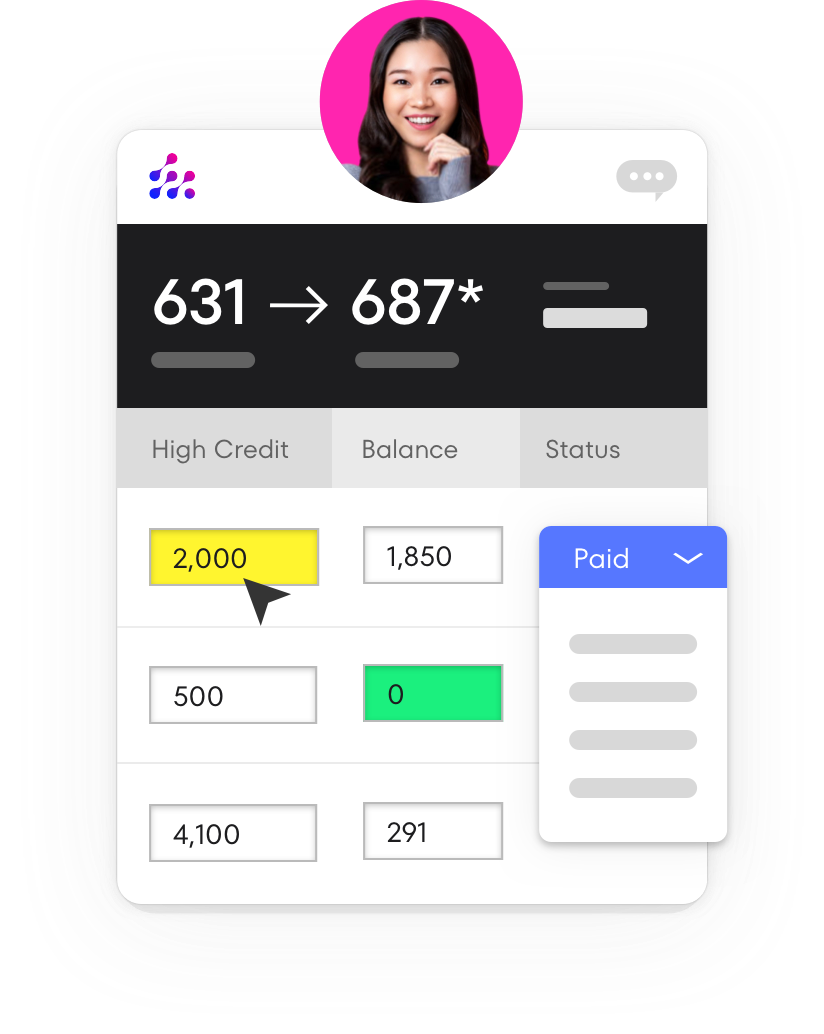

Model endless scenarios with the most powerful Simulation Engine.

What-If Simulator™

Our 20 years of analyzing more than 750M FICO credit scores and credit records make it easy for you to run endless scenarios and produce detailed improvement plans.

Combine your expertise with our analytics.

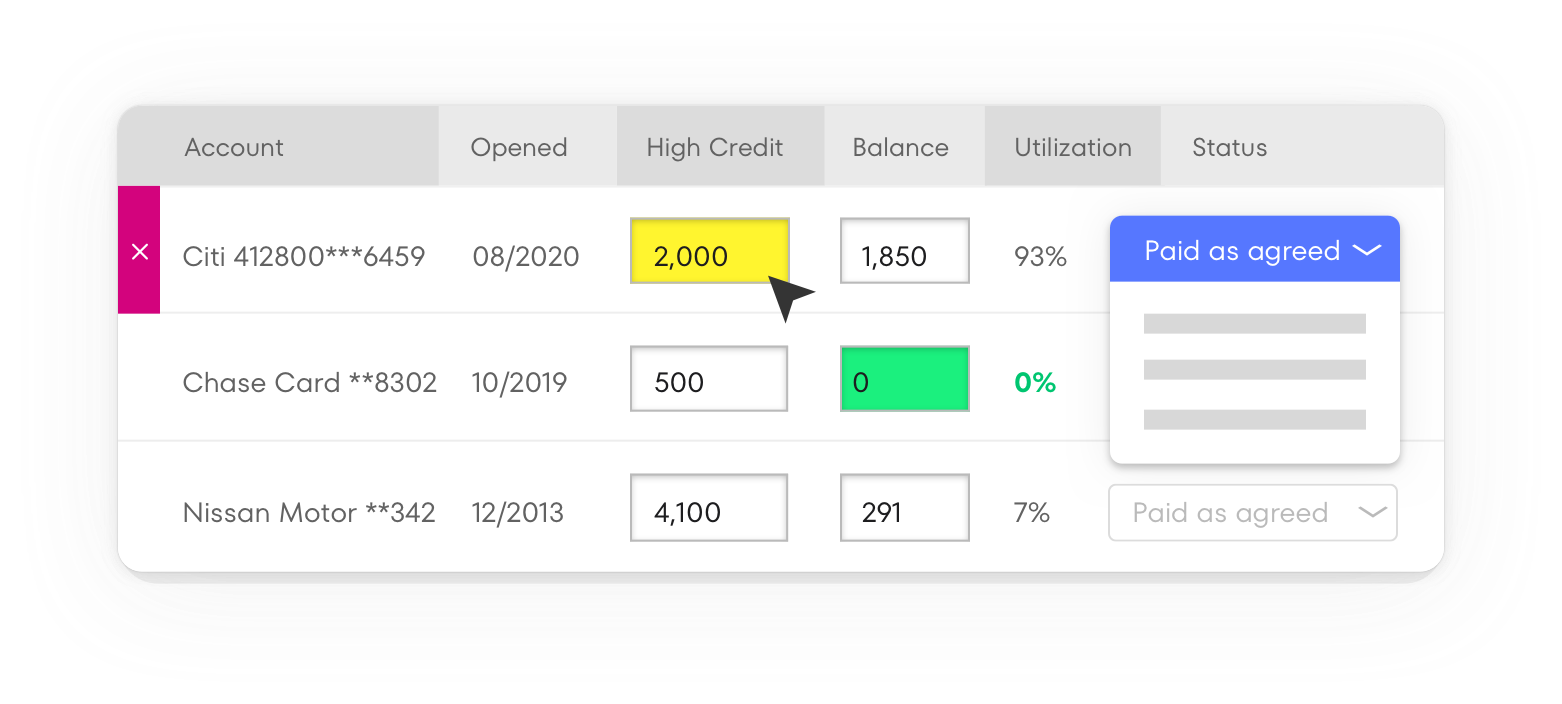

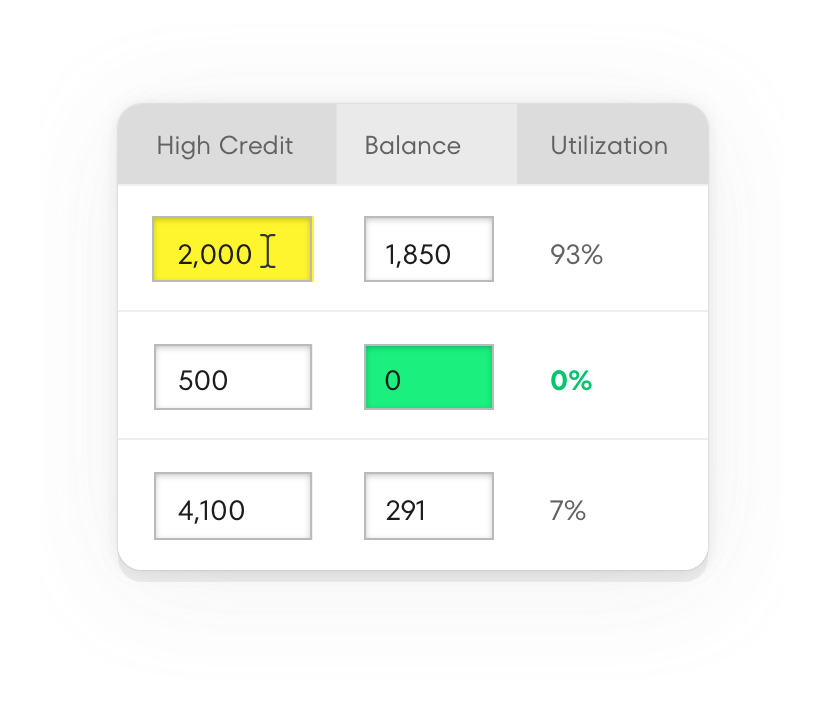

You work with applicants every day to help them qualify for their dream home. Our simulation engine gives you the flexibility you need to work scenarios with your applicants and produce plans you know will bring about the desired changes.

- Paydowns

- Add lines of credit

- Remove authorized users

- Decrease balances

- Close accounts

- New credit inquiries

- Disputes

- And more...

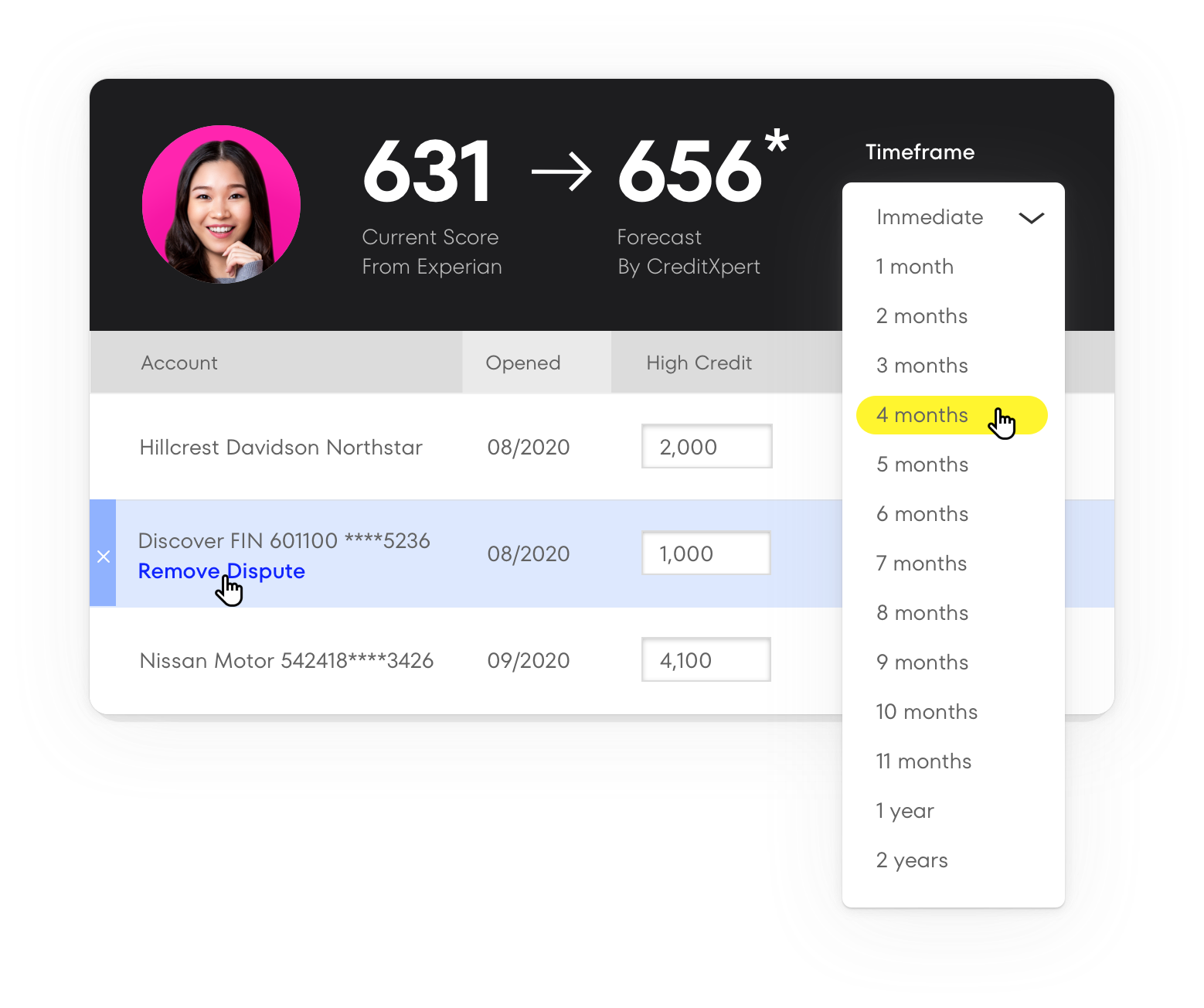

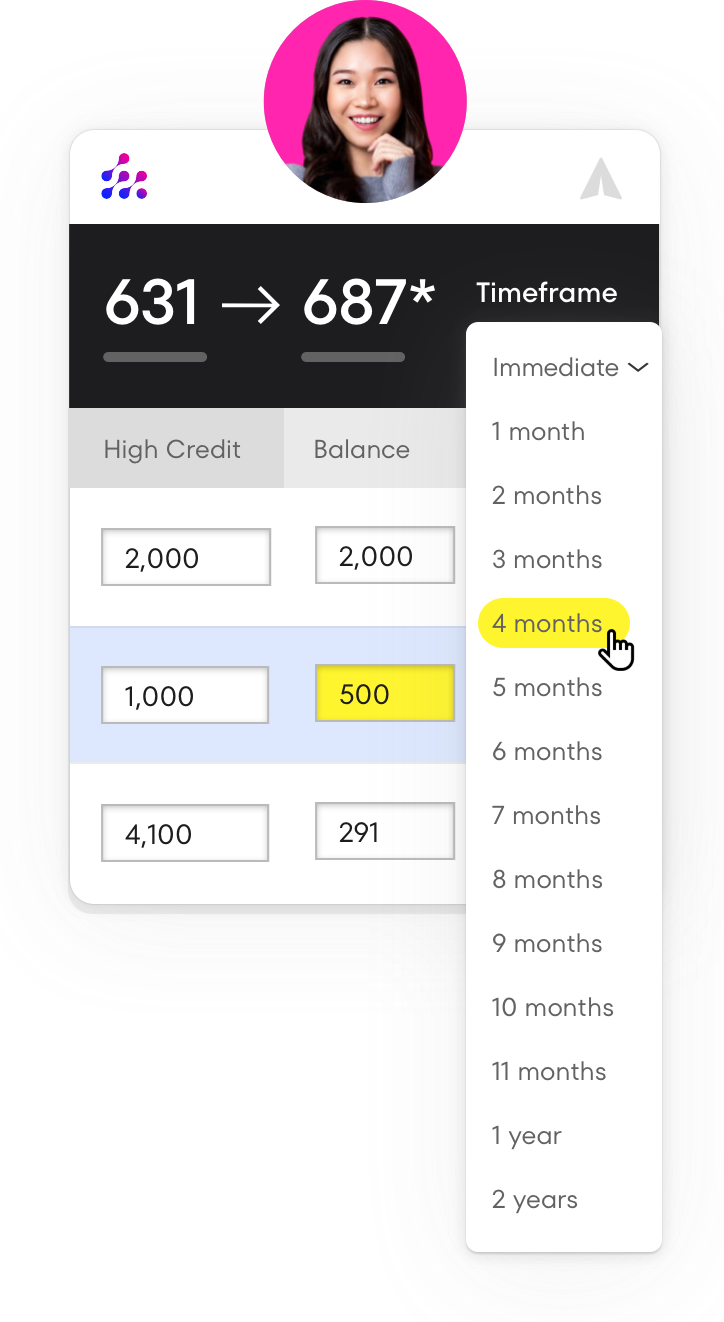

Model the impact of actions over time

Just as Rome wasn’t built in a day, some applicants will need more time to improve their credit score. Our Simulation Engine lets you model changes over several months or up to two years.

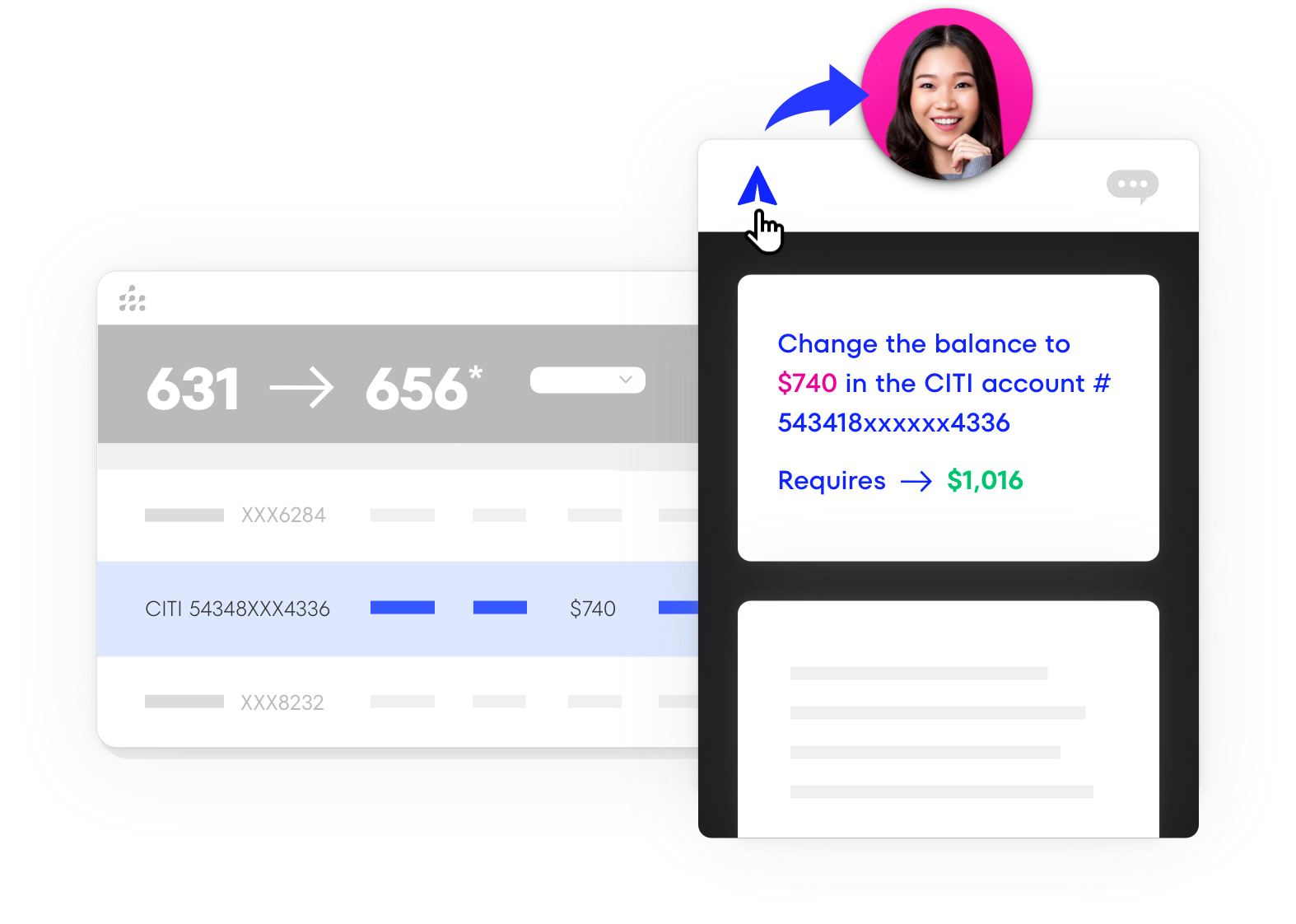

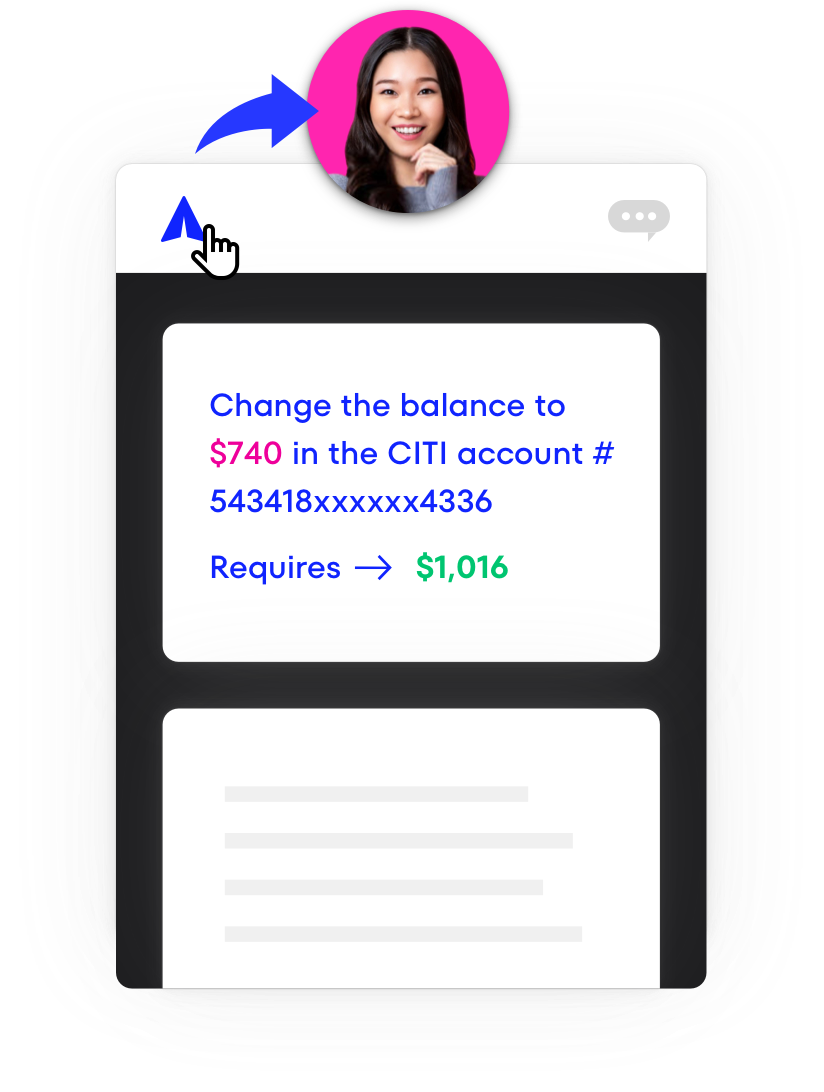

Share the plan with clients in one click.

Show applicants you are doing everything you can to position them for the best rates and terms. Collective changes are tracked and can be shared with applicants. CreditXpert makes it easy to share detailed improvement plans.

Latest Credit Insight

For credit unions focused on financial inclusion, helping more members achieve homeownership is both a mission and an opportunity. Yet 65% of mortgage applicants say they were never offered a chance to improve their credit before applying. CreditXpert changes that. Using predictive analytics trained on over a billion credit reports, CreditXpert identifies each member’s credit potential—the score they could realistically achieve in just 30 days. Whether helping borderline borrowers qualify or lowering rates for well-qualified members, CreditXpert delivers real results. Credit unions can boost approvals, reduce loan costs, and build lifelong member relationships through credit optimization.