The browser you are using is not supported. Please consider using a modern browser.

The enterprise platform built to turn credit into a strategic growth engine.

Stop lead fallout and leaky lead pipeline with our predictive analytics engine. Identify a data-first credit optimization for each borrower, eliminate the guesswork to maximize their credit score opportunity.

Instantly see the improvement potential in every applicant.

Quickly see what it will take to improve the mid-score.

Easily share detailed improvement plans with applicants.

Help avoid surprises at underwriting.

Used by the Nation's top mortgage lenders

Our proprietary algorithms have analyzed more than 750 million credit records. This eliminates guesswork and keeps your focus on finding potential opportunities for applicants to secure the best rates and terms.

Competitive markets call for innovative solutions.

Every applicant’s credit potential right in front of you.

With 73% of applicants able to increase their score by at least 20-points within 30 days, it’s important to have quick access to everyone’s potential. Our AI quickly identifies an applicant’s mid score and a single click will show you their potential and what it will take to get there.

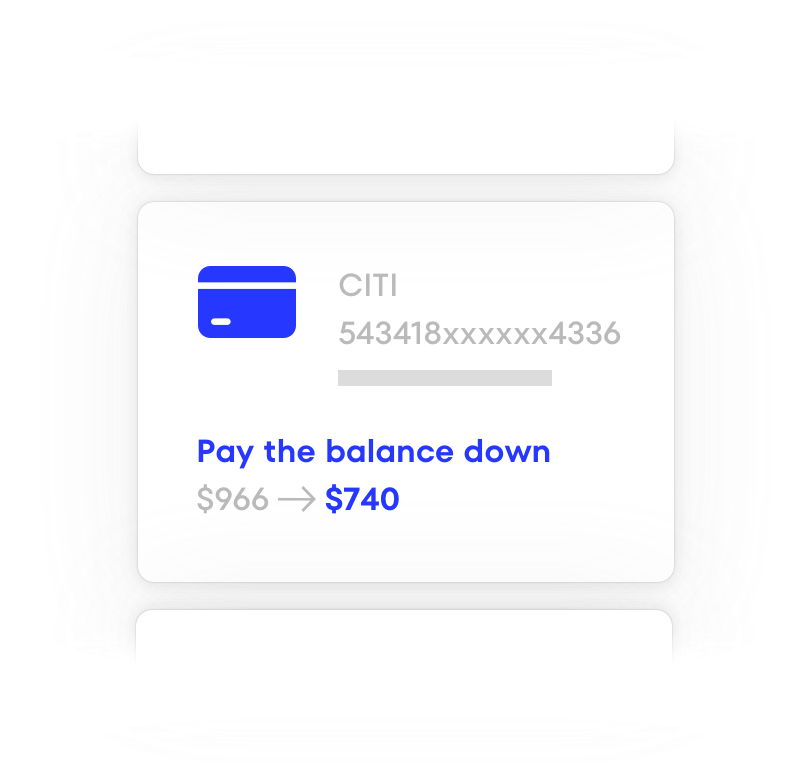

Automatically generate and compare improvement plans in real time.

Savvy homebuyers move quickly to find the lender that is going to give them the most compelling offer. Our predictive analytics engine helps you see an applicant’s credit potential, specific improvement actions and the likelihood of them reaching a target score.

AI that helps you reduce errors and improve efficiency.

CreditXpert’s proprietary algorithms have analyzed nearly 1 billion credit records and can help identify underwriting blockers and pinpoint changes between credit pulls that may have impacted an applicant’s credit score.

See where to find the CreditXpert platform.

Ready to dive in?

CreditXpert is offered through most credit report providers. Whether you purchase credit products from one or more providers, we’ll show you the easiest way to access our platform. Our client success team is also here to give you a tour and answer your questions.

See how others are using our platform.

Equity Mortgage Lending

Ken met with a client whose credit appeared to be exceptional. With interest rates at historic lows, the client wanted to refinance their mortgage. When Ken pulled his client’s credit score, they were both perplexed that it was 699 – relatively low given their overall credit standing. The client couldn’t figure out the reason their score wasn’t higher.

100+ Point Increase on Credit Score

HomeBridge Financial Services

Mark’s client needed to raise her credit score from 590 to 640 – just 50 points – to have a chance for an FHA loan. Most of her debt was due to credit card balances. Mark used CreditXpert® What-If Simulator™ to look for ways to pay down the debt that wouldn’t require a lot of funds.

50 Point Increase on Credit Score

PrimeLending

Rod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site.

18 Point Increase on Credit Score

Latest Credit Insights

Help your bank meet CRA goals with compliance‑safe credit optimization. CreditXpert empowers legal and compliance teams to boost Lending Test scores, qualify more LMI borrowers, and deliver measurable, exam‑ready community impact.

Boost CRA scores and grow mortgage lending in underserved LMI markets. Discover how CreditXpert’s compliance‑safe credit optimization turns borderline applicants into qualified borrowers—driving market share and CRA success.

Compliance leaders can improve CRA results fast. CreditXpert’s data‑driven, compliance‑safe credit optimization turns borderline applicants into qualified borrowers while enhancing Lending Test performance.