The browser you are using is not supported. Please consider using a modern browser.

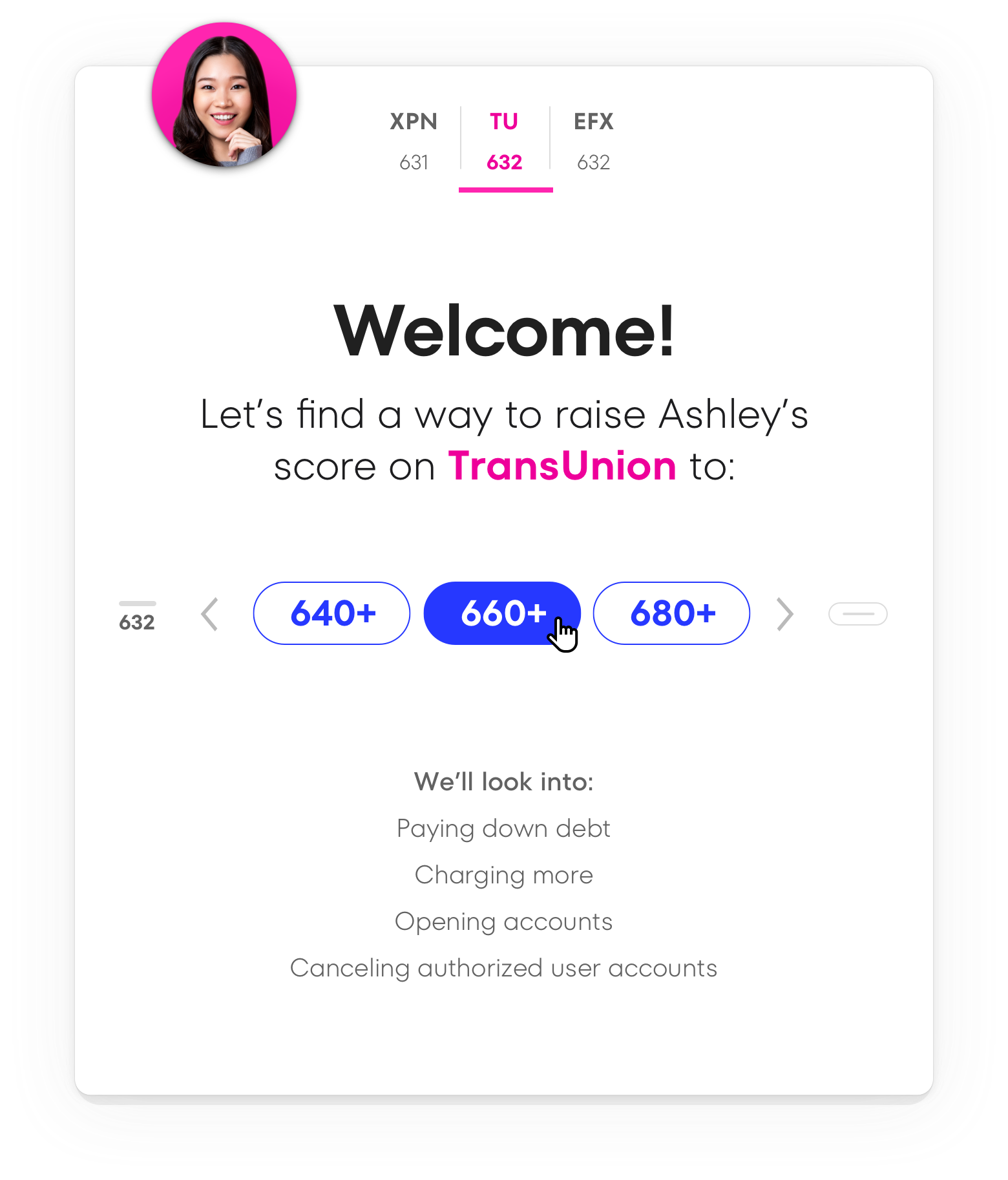

Alerts on improvement potential right in front of you.

Credit Assure™

Immediately see if your applicants might qualify for better rates and terms – it’s all right in the credit report.

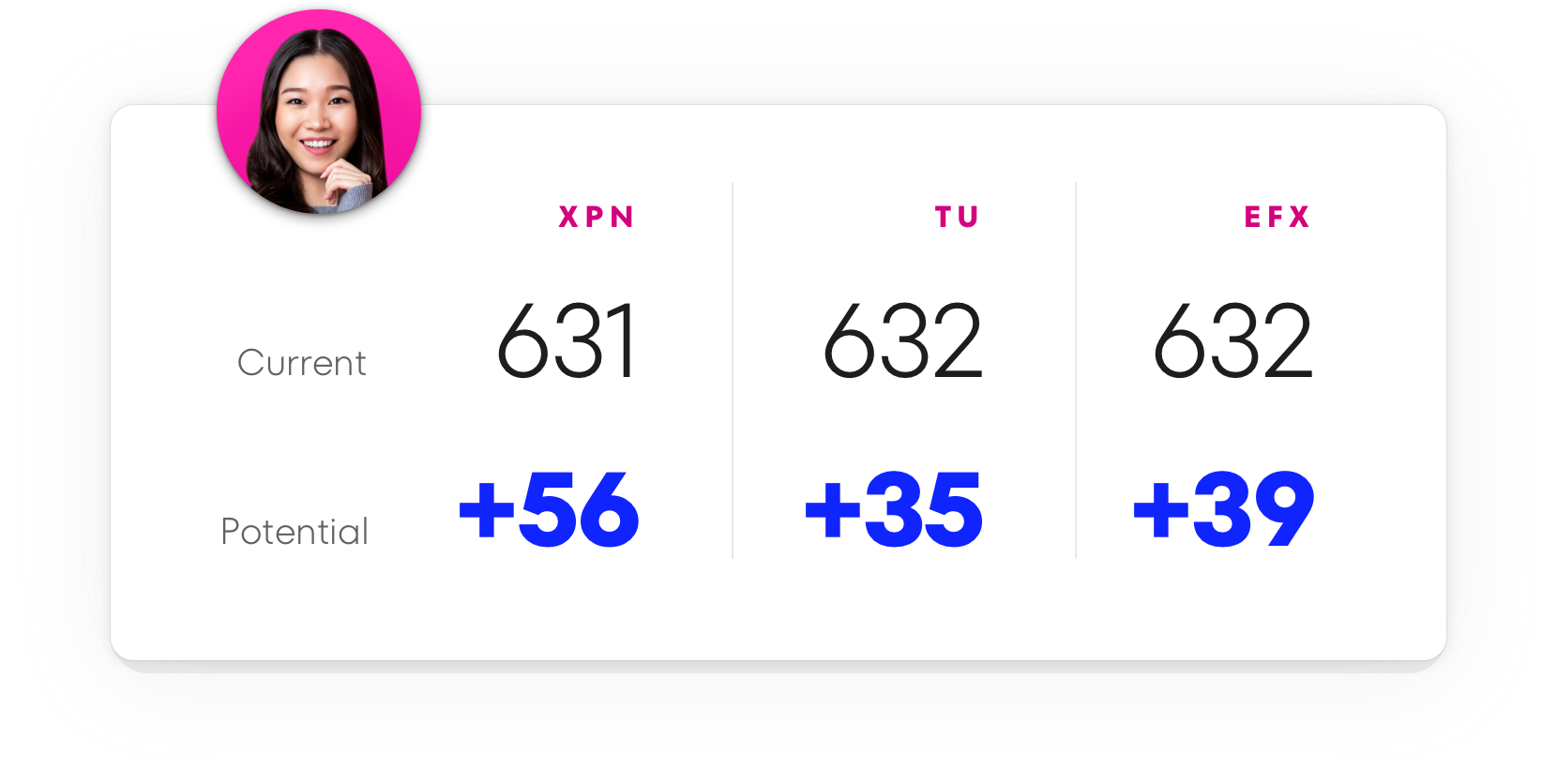

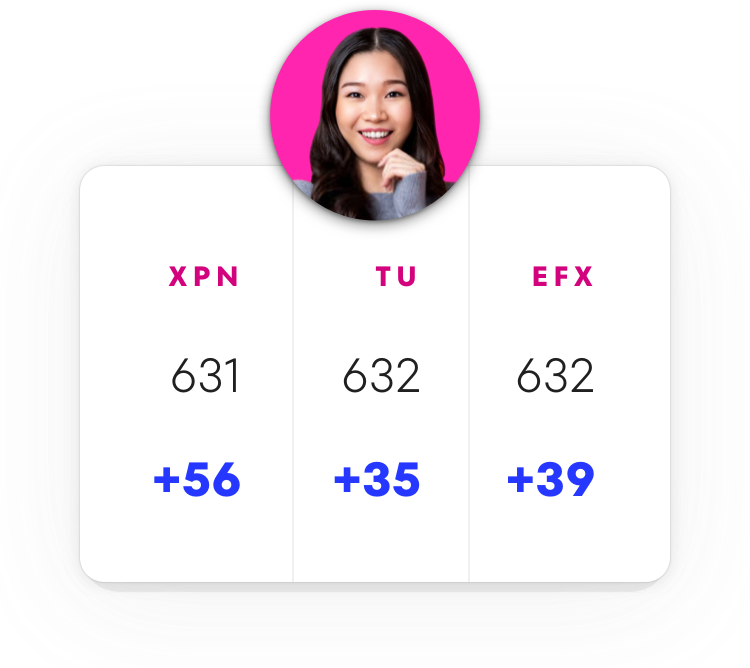

Look for the +

If you spend time with credit reports, applicants’ improvement potential is likely right before your eyes. We’ll show you the improvement potential for Experian, Transunion and Equifax scores.

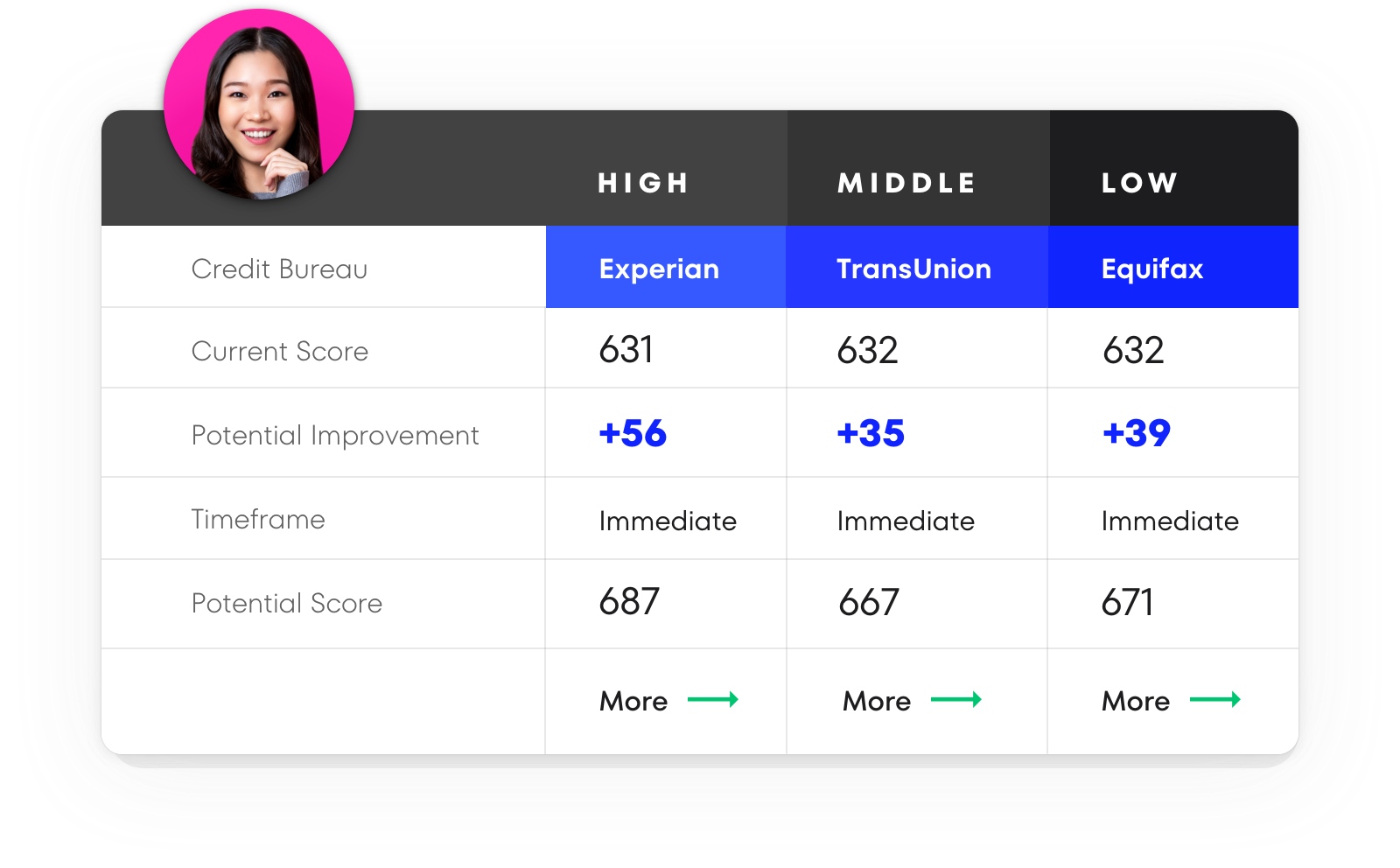

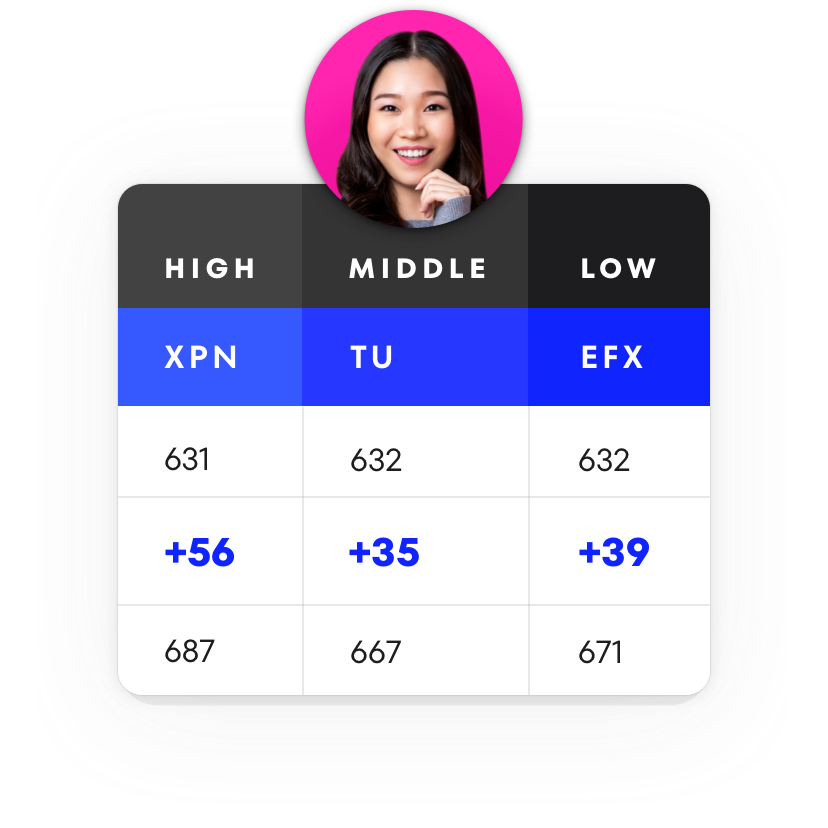

Build detailed improvement plans

There’s a big difference between potential and making things happen. That’s why we make it easy to go from a potential score to an actionable plan that can help applicants secure better rates and terms.

Latest Credit Insight

For credit unions focused on financial inclusion, helping more members achieve homeownership is both a mission and an opportunity. Yet 65% of mortgage applicants say they were never offered a chance to improve their credit before applying. CreditXpert changes that. Using predictive analytics trained on over a billion credit reports, CreditXpert identifies each member’s credit potential—the score they could realistically achieve in just 30 days. Whether helping borderline borrowers qualify or lowering rates for well-qualified members, CreditXpert delivers real results. Credit unions can boost approvals, reduce loan costs, and build lifelong member relationships through credit optimization.