The browser you are using is not supported. Please consider using a modern browser.

Alerts on improvement potential right in front of you.

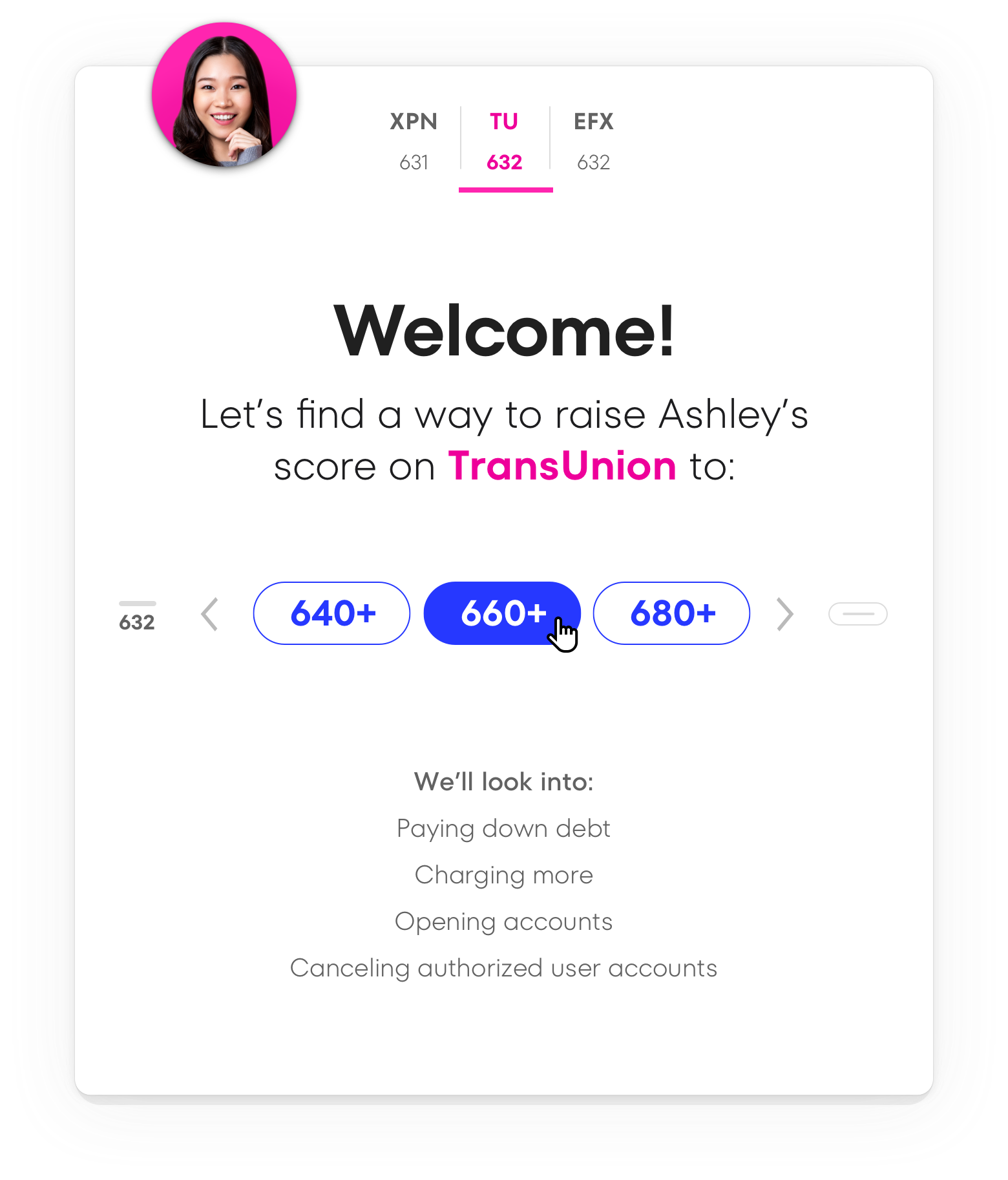

Credit Assure™

Immediately see if your applicants might qualify for better rates and terms – it’s all right in the credit report.

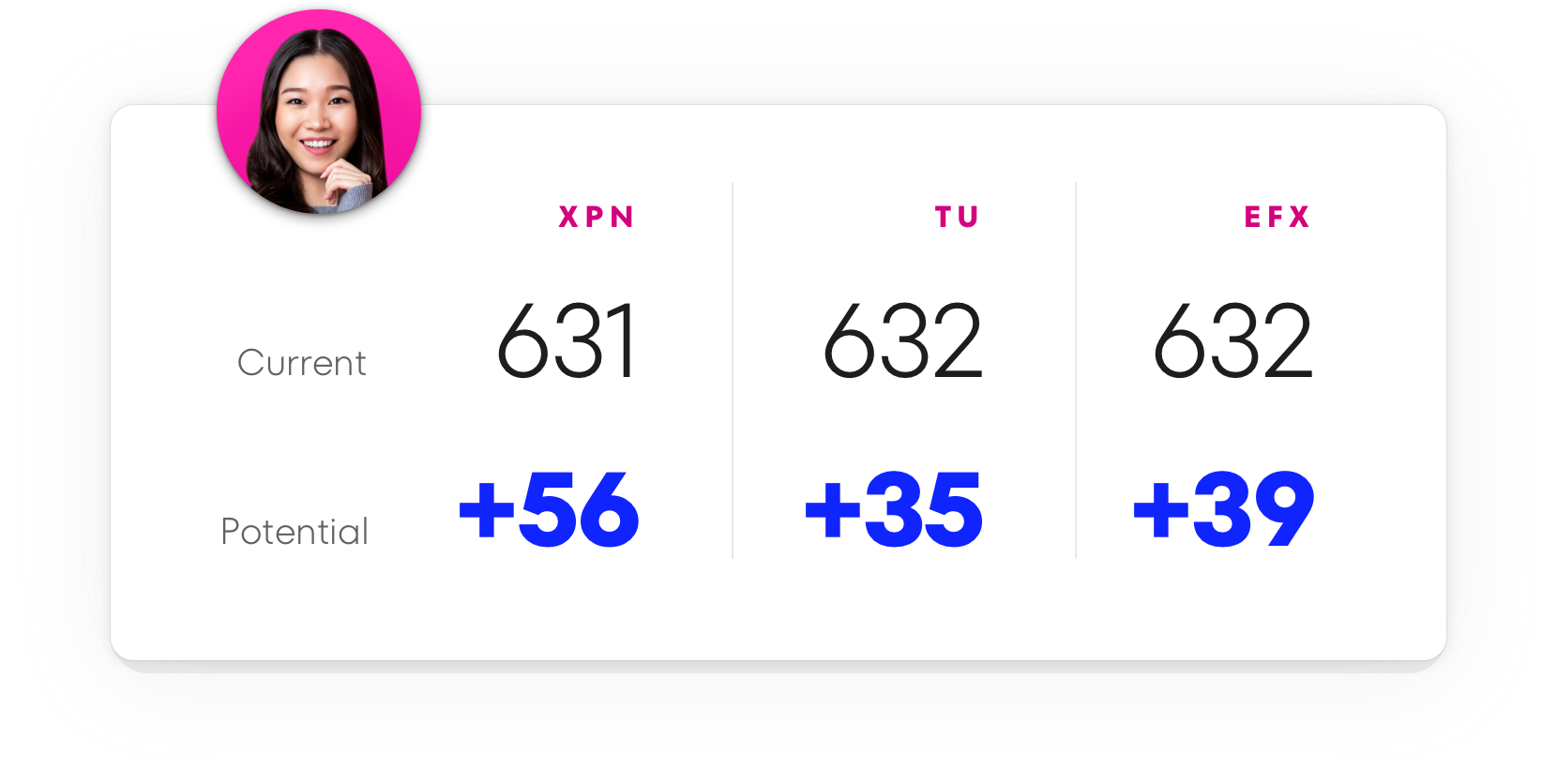

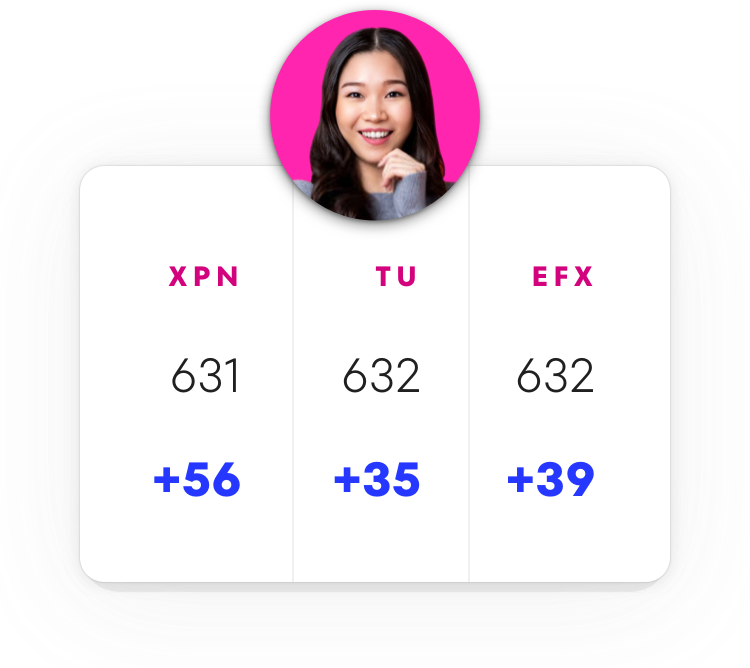

Look for the +

If you spend time with credit reports, applicants’ improvement potential is likely right before your eyes. We’ll show you the improvement potential for Experian, Transunion and Equifax scores.

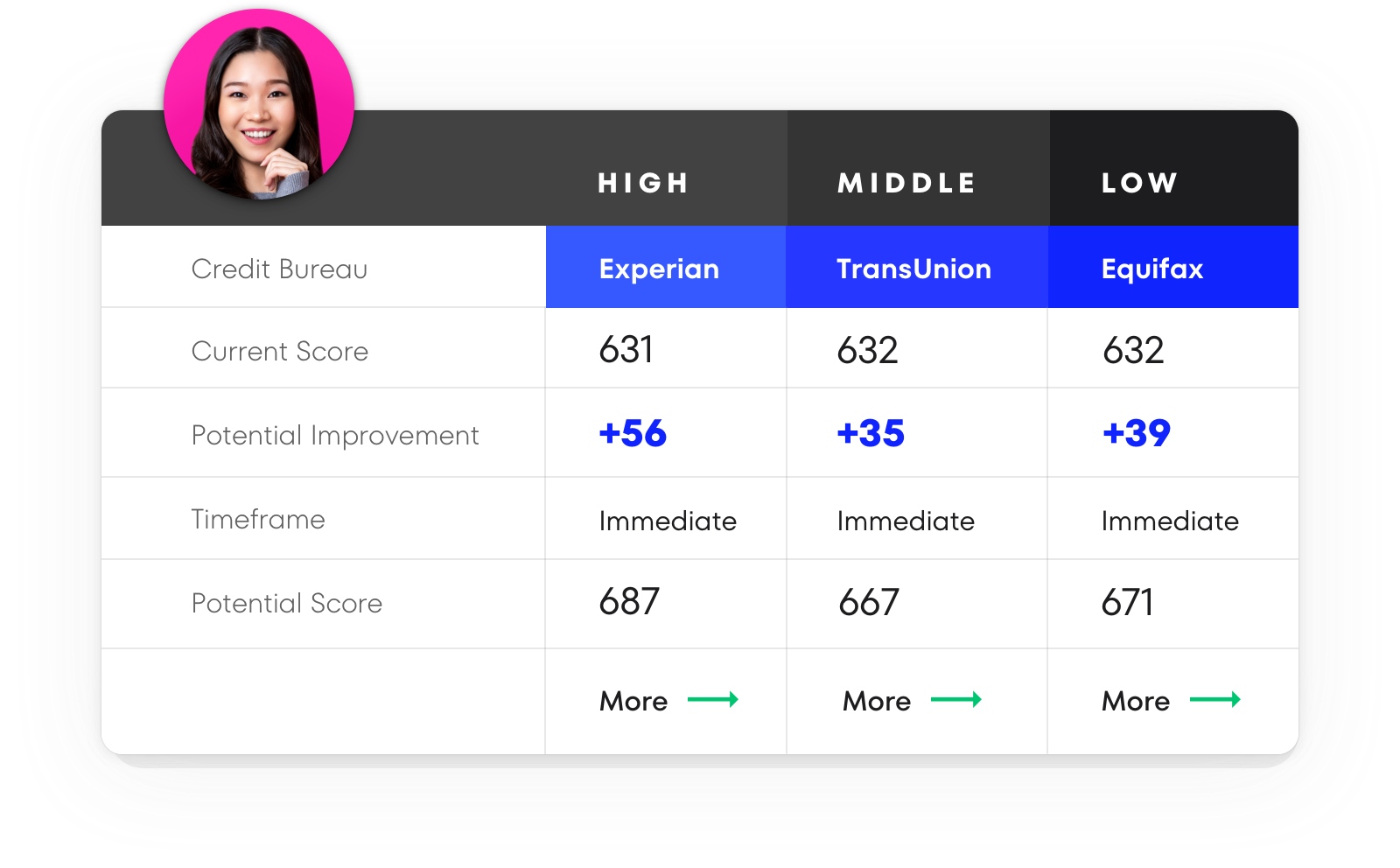

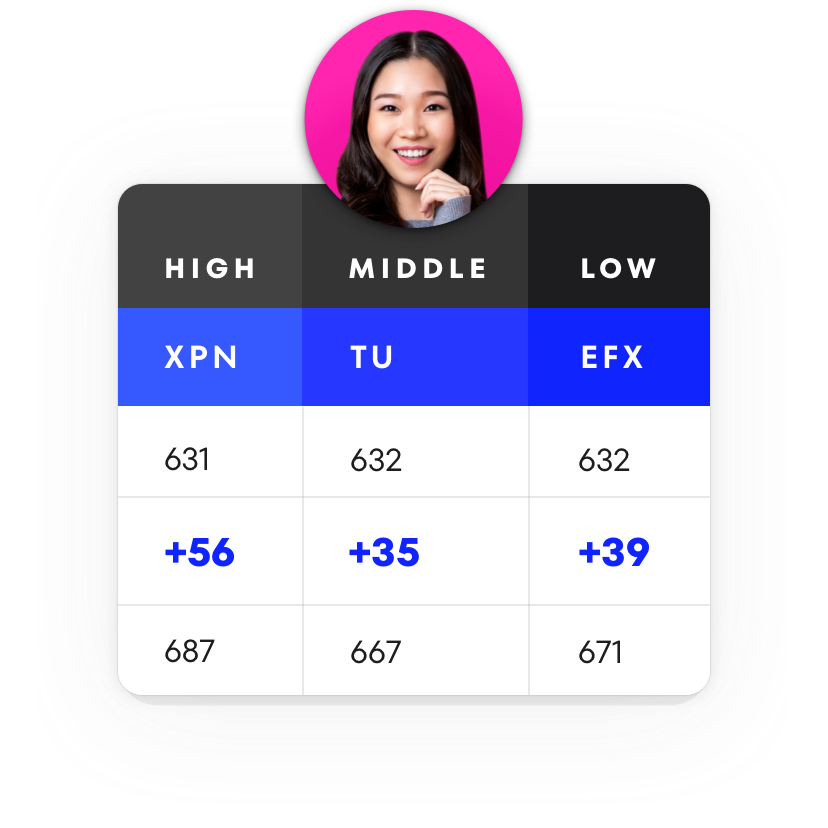

Build detailed improvement plans

There’s a big difference between potential and making things happen. That’s why we make it easy to go from a potential score to an actionable plan that can help applicants secure better rates and terms.

Latest Credit Insight

Help your bank meet CRA goals with compliance‑safe credit optimization. CreditXpert empowers legal and compliance teams to boost Lending Test scores, qualify more LMI borrowers, and deliver measurable, exam‑ready community impact.