The browser you are using is not supported. Please consider using a modern browser.

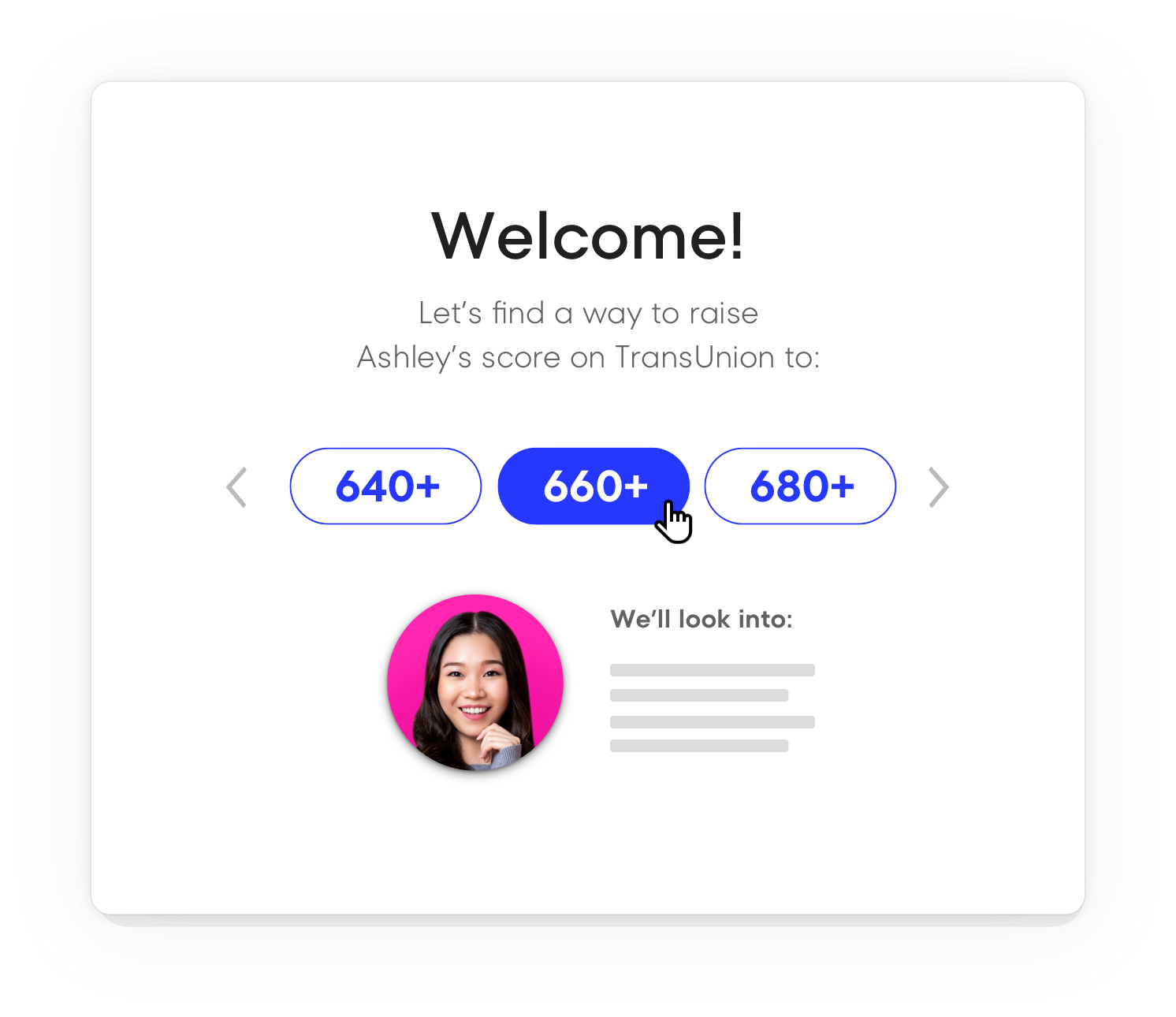

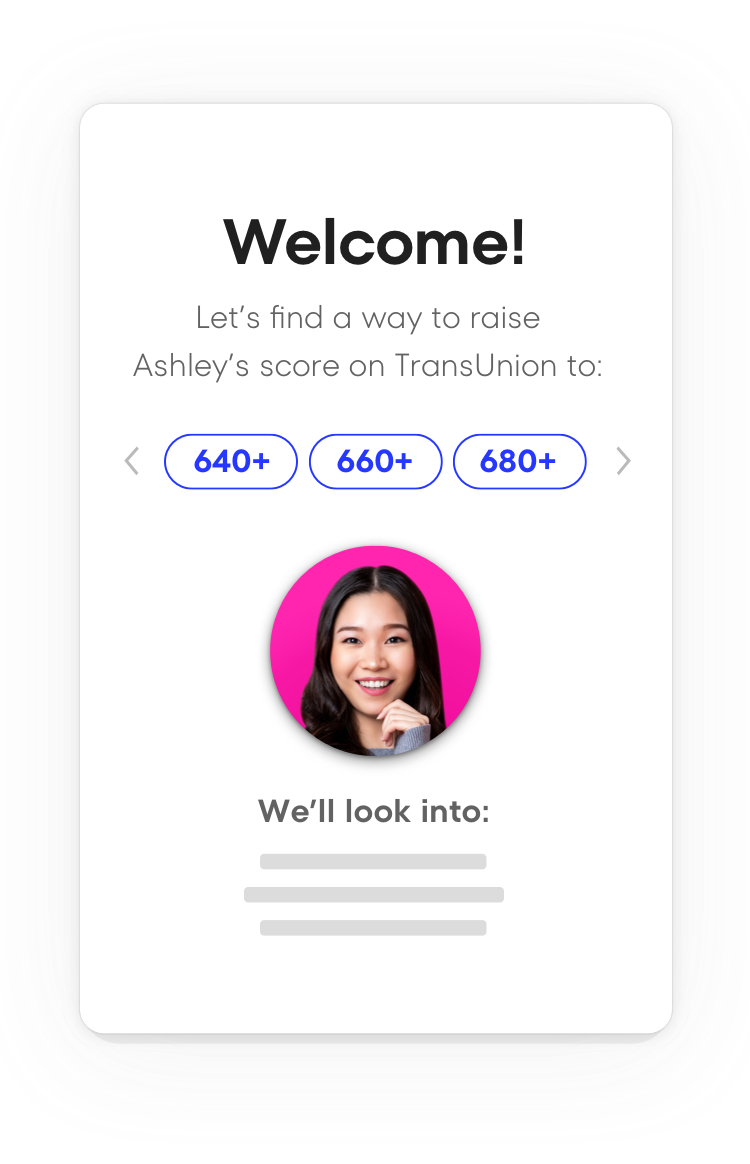

Show applicants the best rates and terms with Automated Plans.

Wayfinder™

You don’t need to be an Xpert in all things credit to show your applicants that you’re positioning them to get the best rates and terms.

Know for certain

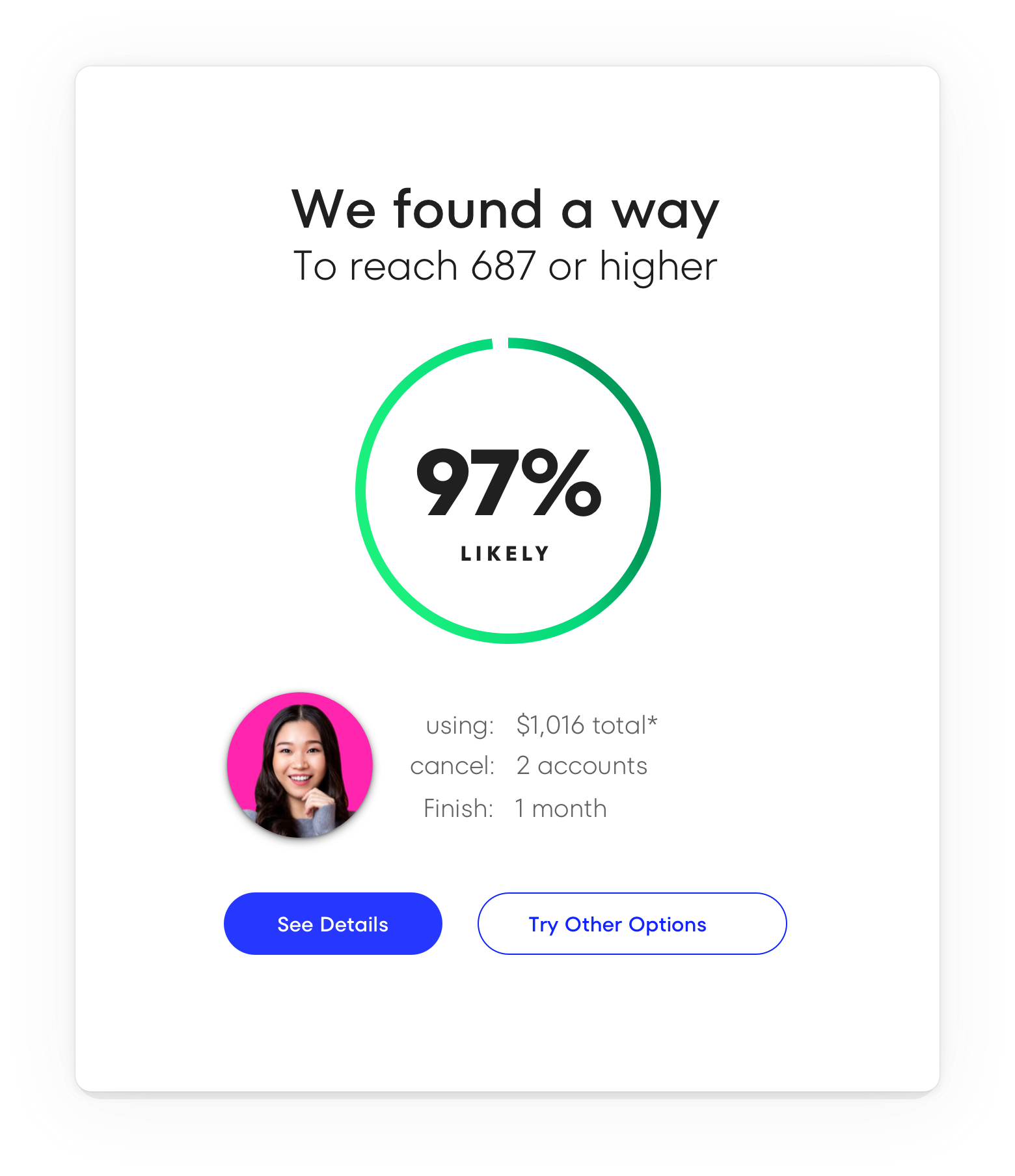

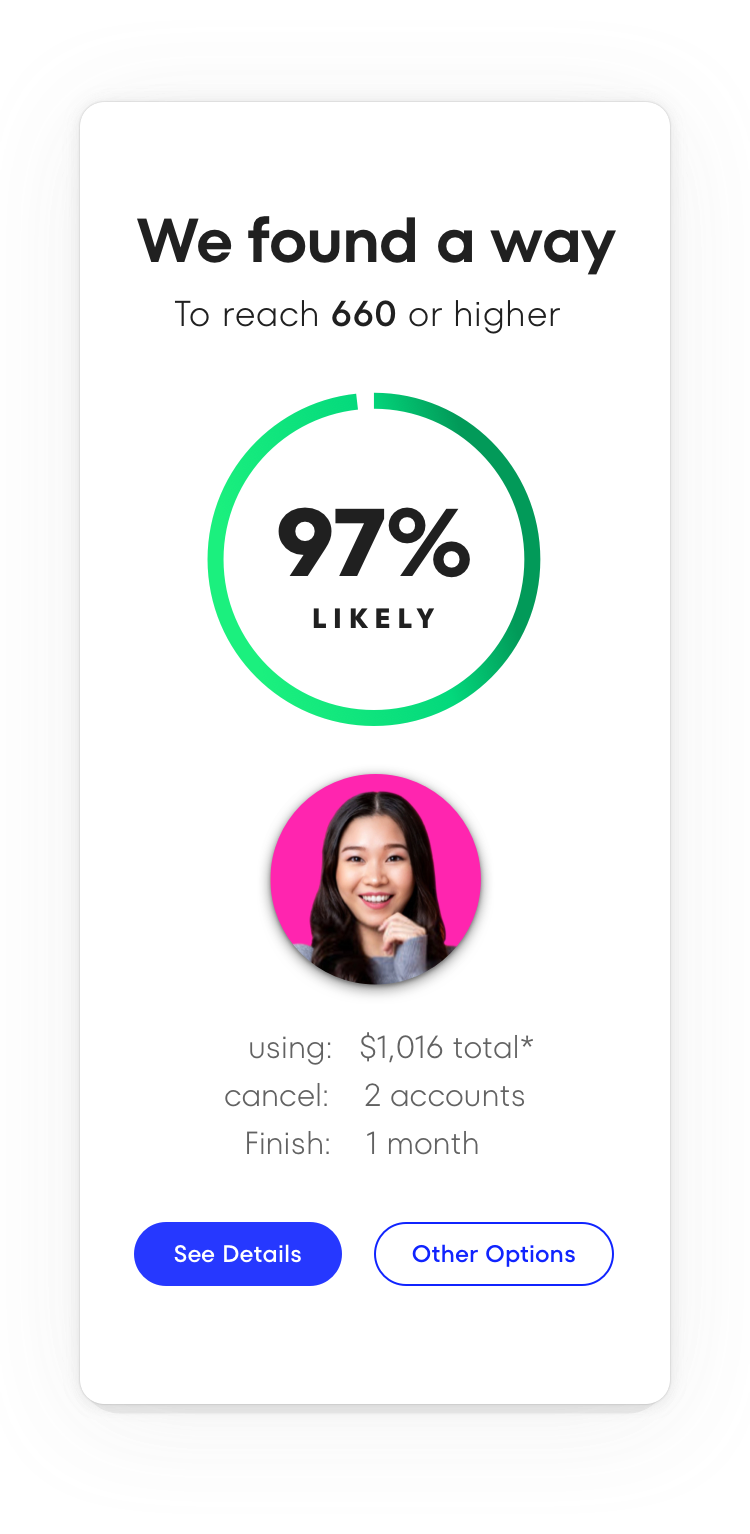

Closing mortgage loans is fast-paced and competitive. You likely don’t have time to become an expert in the nuances of credit – that’s where we come in. We show you the likelihood of achieving a target score.

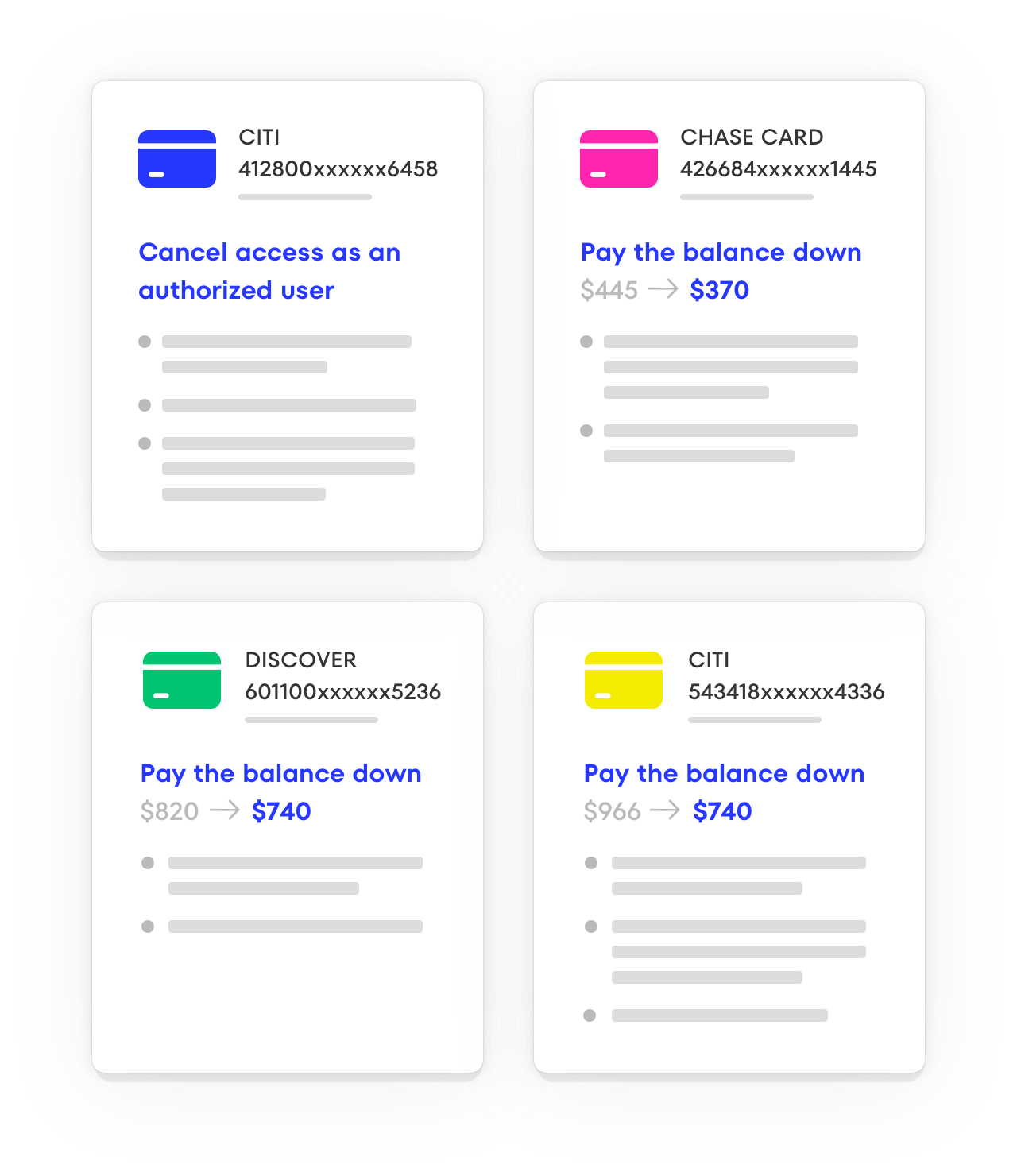

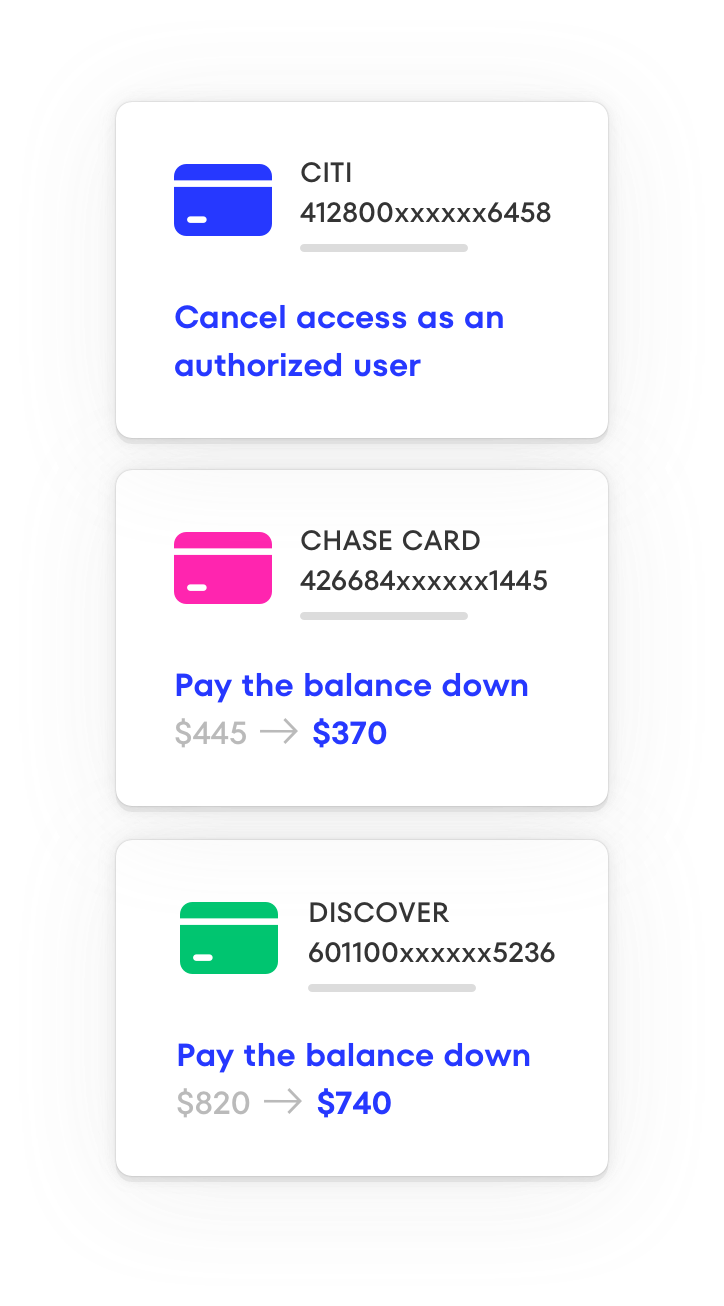

Relax, we build detailed plans for you

Over the years our products have analyzed more than 750M FICO credit records. This means we know what actions are likely to drive the score improvements you are seeking for your clients. Our detailed plans help your clients identify changes that could save them thousands.

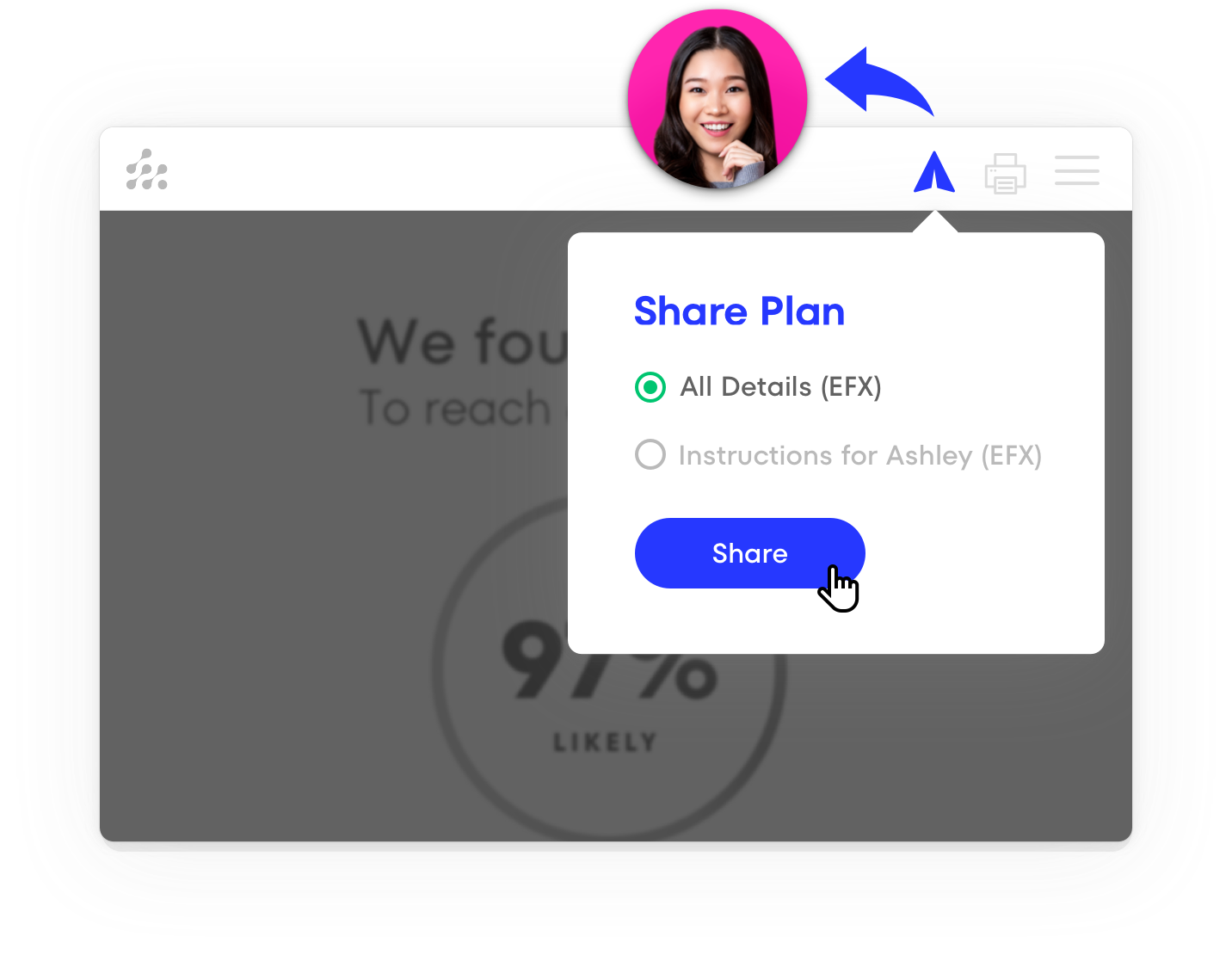

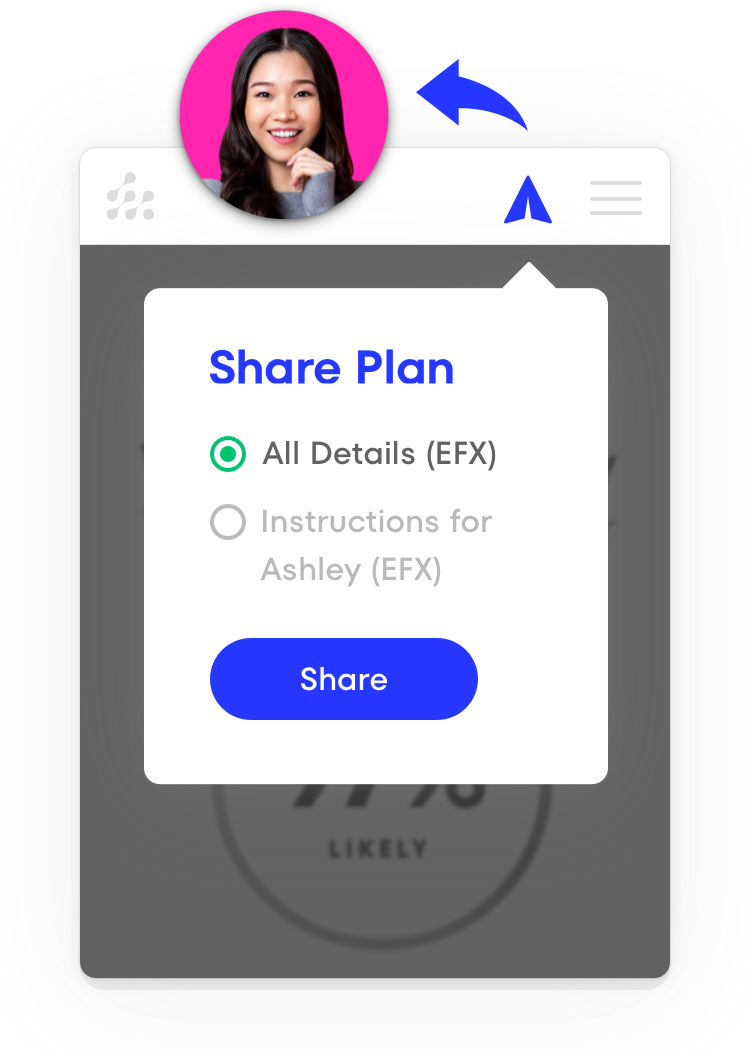

Share plans with clients in one click

Do applicants know you are doing everything you can to position them for the best rates and terms? Easily share score potential and detailed improvement plans with applicants.

Avoid underwriting surprises

The last thing you want is an unwelcome surprise at underwriting. We highlight actions that could impact an applicant’s score

Latest Credit Insight

Mortgage loan fallout—approved loans that fail to close—costs lenders money, time, and relationships. Causes range from credit score declines and rate lock expirations to appraisal issues and borrower disengagement. Targeted strategies like pre-closing credit monitoring, smart lock management, and strong borrower-agent engagement can reduce fallout, improving profitability, efficiency, and market reputation.