The browser you are using is not supported. Please consider using a modern browser.

The easiest way to upgrade to the new CreditXpert.

See what package you're eligible for.

Compare CreditXpert Platform and Tools

| Core Features | |||

|---|---|---|---|

| Credit data seamlessly integrated into a single platform from ALL Resellers | Ordered separately from each Reseller's portal Ordered separately | Ordered separately from each Reseller's portal Ordered separately | Integrated |

| EVERY borrower's Credit Potential automatically displayed in a single-feed | Displayed AFTER you order an improvement plan from your Reseller AFTER you order | Automatic | |

| Seamless flow from insights > automated plans > simulations | Seamless Flow | ||

| Real-time product updates pushed as soon as they become available | Update frequency limited to your Reseller deployment schedule Limited to Reseller schedule | Update frequency limited to your Reseller deployment schedule Limited to Reseller schedule | Real-time |

| Supports new credit requirements and new credit models | Supported | ||

| Sign up directly from CreditXpert for FREE | Monthly Subscription | ||

| Security | |||

| Enhanced AWS security measures, FIPS approved encryption algorithms and ISO 27001:2022 and SOC 2 Type II certified | Managed by each Reseller Managed by Reseller | Managed by each Reseller Managed by Reseller | Enhanced Security |

| Plan Creation | |||

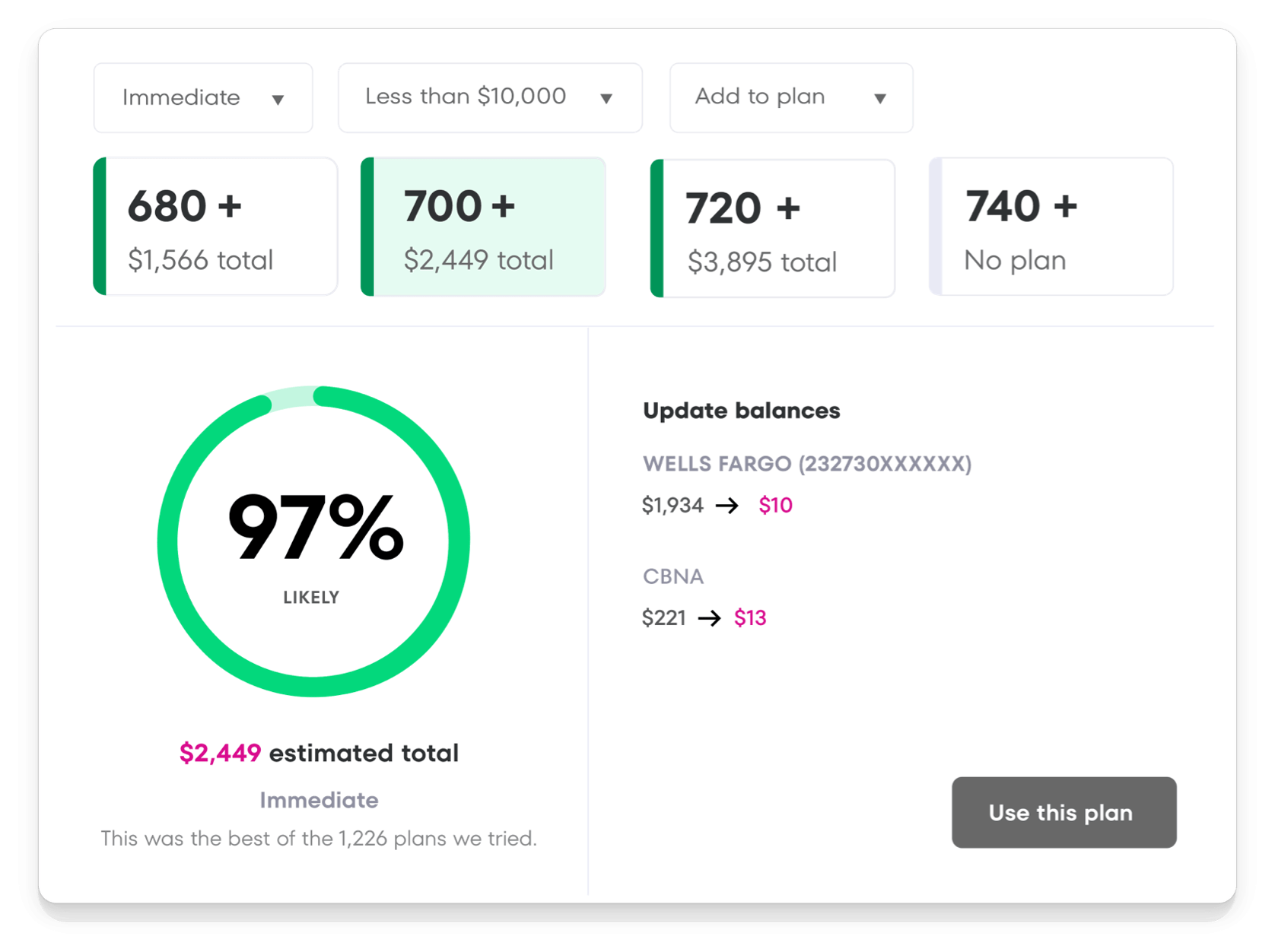

| Multi-bureau optimized plans and mid-score identification | Single bureau insights only Single bureau | Single bureau insights only Single bureau | Multi-bureau optimized |

| Plan achievement likelihood | Included | Not Included AFTER you order | Included |

| Automated plans with timelines from immediate to 12 months | Immediate and 30-days ONLY | Manually simulate plans from immediate to 12 months Manually simulated | Automated |

| Date of last tradeline reported automatically displayed in plan details | Not Included | Only on PDF AFTER plan is manually created AFTER plan created | Automatic |

| Plans can be delivered by branded PDF or secure borrower portal | PDF Plans or emailed by cut-and-paste from plan | PDF Plans or emailed by cut-and-paste from plan | Delivered by portal |

| Plan completion tracking and automated borrower reminders | Completion Tracking | ||

| Easily see what caused a borrower to not reach a target score at the tradeline and bureaus level | See causes | ||

| Management & Insights | |||

| Easy, real time role and permission control | Controlled by Reseller access Controlled by Reseller | Controlled by Reseller access Controlled by Reseller | Role and permission control |

| Dynamic management reporting and insight dashboard | Dynamic reports and dashboard |