The browser you are using is not supported. Please consider using a modern browser.

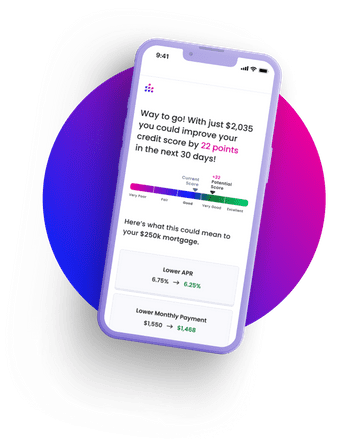

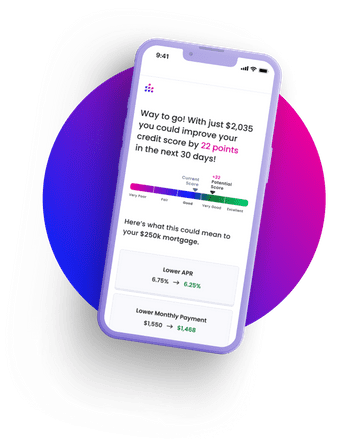

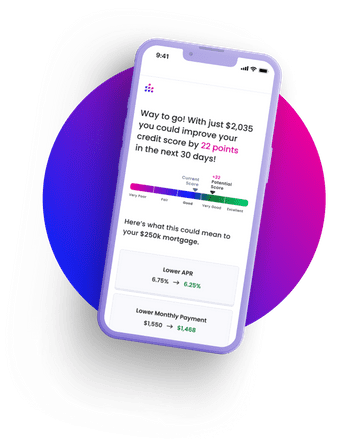

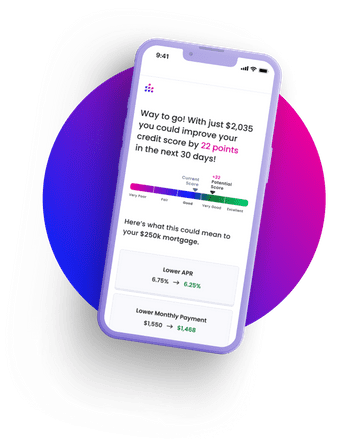

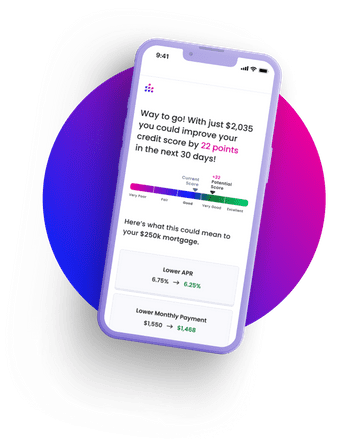

Higher credit scores. Better mortgage rates. Lower monthly payments.

This is not credit repair. CreditXpert tools were developed to help you get the best deal on your mortgage. Using sophisticated predictive analytics, our free tool will help you lower your monthly payments.

With CreditXpert, 73%* of applicants experience a 20+ point increase in their credit score.

Join the homeowners who improved their credit scores within 30 days.

Credit's Complicated. We're here to help.

How does my credit score impact my monthly mortgage payment?

Should I just start paying down my balances to optimize my credit?

What’s the difference between credit repair, credit counseling and CreditXpert?

Credit repair and credit counseling are services performed by teams of people that provide guidance to consumers who need help with credit disputes or improving their money management skills. CreditXpert has developed sophisticated predictive analytics to help mortgage applicants achieve the highest credit score possible. Our tool generates custom plans with actionable steps to raise your score, such as paying off a loan, opening a new card, or requesting a balance increase.

How do I lock in my new credit score?

You’ll be connected with lenders that can create a custom improvement plan with using CreditXpert’s proprietary technology for lenders. The improvement plan will include the specific steps needed to reach your target score. All you have to do is complete the recommended steps. Are you already working with a lender? Send them your credit potential report and they can contact CreditXpert directly.

Get the best deal on your mortgage.

Our free tool makes good credit scores great. So you can go all out on your housewarming party.

As a lender, you have options when pre-qualifying borrowers for a mortgage. You can run a soft or hard credit pull. Soft credit pulls offer more benefits, increasing your chances of keeping the lead and saving you money. Sometimes a lot of money — depending the on the credit reporting agency, a soft credit pull could be just a quarter of the cost of a hard credit pull.

For credit unions focused on financial inclusion, helping more members achieve homeownership is both a mission and an opportunity. Yet 65% of mortgage applicants say they were never offered a chance to improve their credit before applying. CreditXpert changes that. Using predictive analytics trained on over a billion credit reports, CreditXpert identifies each member’s credit potential—the score they could realistically achieve in just 30 days. Whether helping borderline borrowers qualify or lowering rates for well-qualified members, CreditXpert delivers real results. Credit unions can boost approvals, reduce loan costs, and build lifelong member relationships through credit optimization.

A Home Equity Line of Credit (HELOC) offers homeowners flexible access to funds using their home's equity as collateral. Unlike a home equity loan which provides a lump sum, a HELOC works like a credit card with a draw period (typically 10 years) where you can borrow and repay repeatedly, paying interest only on what you use.

Mortgage lending and credit can be complicated. That’s why we worked to simplify the benefits of Credit Optimization into easy to understand “plays.” Think of these plays as strategies you can deploy across your prospect pool that can help you convert more leads, qualify more borrowers, build deeper relationships, close more loans and even improve margins.