The browser you are using is not supported. Please consider using a modern browser.

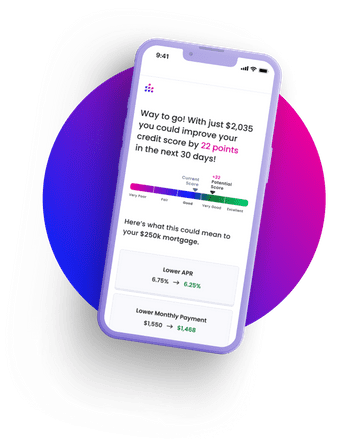

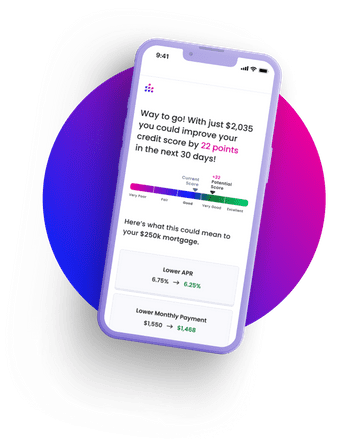

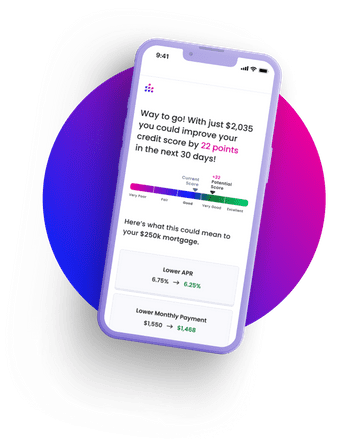

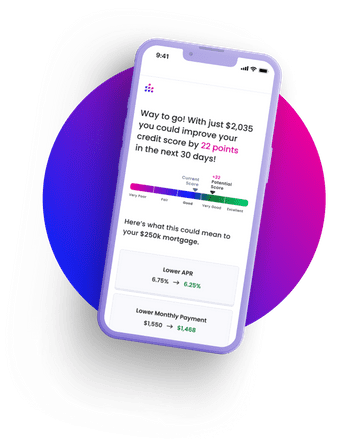

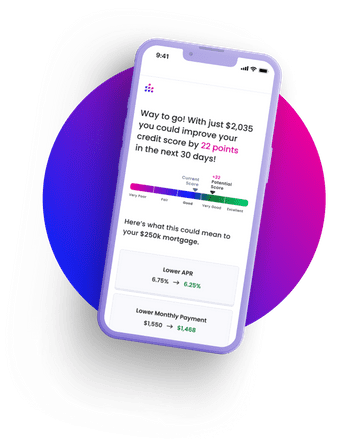

Higher credit scores. Better mortgage rates. Lower monthly payments.

This is not credit repair. CreditXpert tools were developed to help you get the best deal on your mortgage. Using sophisticated predictive analytics, our free tool will help you lower your monthly payments.

With CreditXpert, 73%* of applicants experience a 20+ point increase in their credit score.

Join the homeowners who improved their credit scores within 30 days.

Credit's Complicated. We're here to help.

How does my credit score impact my monthly mortgage payment?

Should I just start paying down my balances to optimize my credit?

What’s the difference between credit repair, credit counseling and CreditXpert?

Credit repair and credit counseling are services performed by teams of people that provide guidance to consumers who need help with credit disputes or improving their money management skills. CreditXpert has developed sophisticated predictive analytics to help mortgage applicants achieve the highest credit score possible. Our tool generates custom plans with actionable steps to raise your score, such as paying off a loan, opening a new card, or requesting a balance increase.

How do I lock in my new credit score?

You’ll be connected with lenders that can create a custom improvement plan with using CreditXpert’s proprietary technology for lenders. The improvement plan will include the specific steps needed to reach your target score. All you have to do is complete the recommended steps. Are you already working with a lender? Send them your credit potential report and they can contact CreditXpert directly.

Get the best deal on your mortgage.

Our free tool makes good credit scores great. So you can go all out on your housewarming party.

As a lender, you have options when pre-qualifying borrowers for a mortgage. You can run a soft or hard credit pull. Soft credit pulls offer more benefits, increasing your chances of keeping the lead and saving you money. Sometimes a lot of money — depending the on the credit reporting agency, a soft credit pull could be just a quarter of the cost of a hard credit pull.

Boost CRA scores and grow mortgage lending in underserved LMI markets. Discover how CreditXpert’s compliance‑safe credit optimization turns borderline applicants into qualified borrowers—driving market share and CRA success.

Compliance leaders can improve CRA results fast. CreditXpert’s data‑driven, compliance‑safe credit optimization turns borderline applicants into qualified borrowers while enhancing Lending Test performance.

In the evolving mortgage market, keeping borrowers loyal while attracting top talent is tougher than ever. Rates alone won’t set you apart — success depends on a modern, reliable tech stack that delivers speed, personalization, and trust. Your tech stack isn’t just operational — it’s your competitive edge. By combining personalization, innovation, and transparency, lenders can increase retention, improve recruiting, and thrive in today’s market.