The browser you are using is not supported. Please consider using a modern browser.

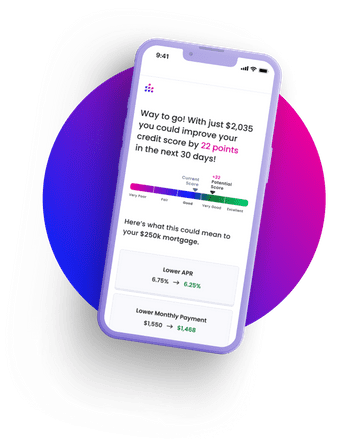

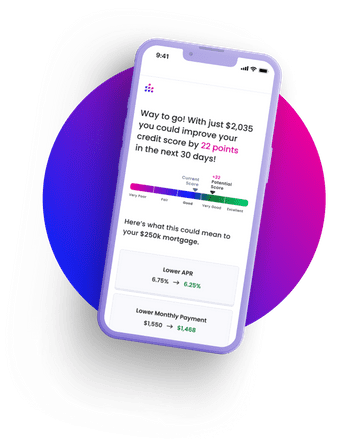

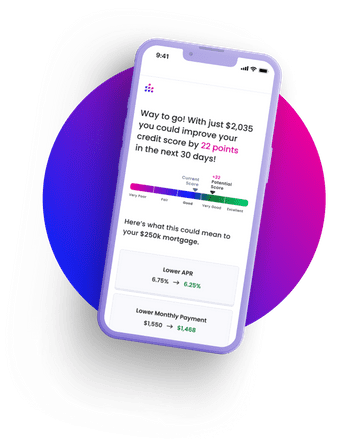

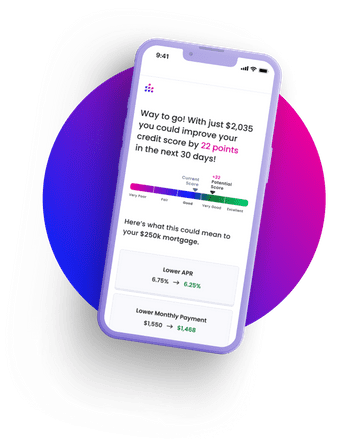

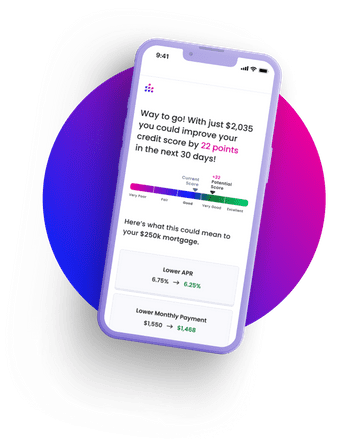

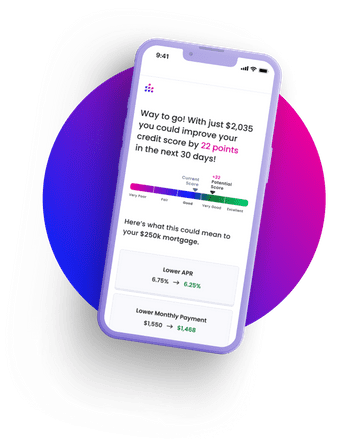

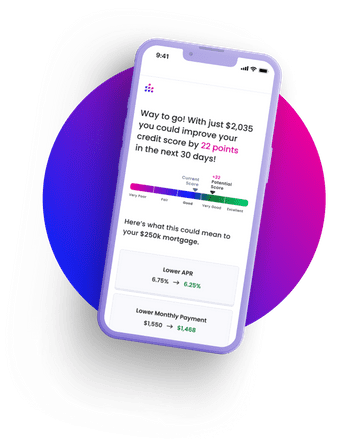

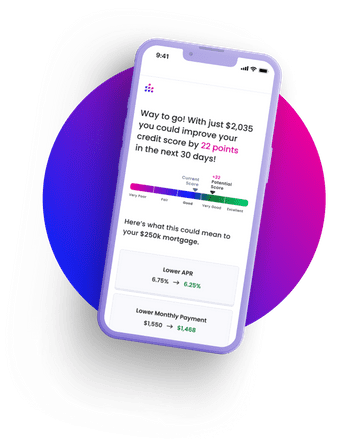

Higher credit scores. Better mortgage rates. Lower monthly payments.

This is not credit repair. CreditXpert tools were developed to help you get the best deal on your mortgage. Using sophisticated predictive analytics, our free tool will help you lower your monthly payments.

With CreditXpert, 73%* of applicants experience a 20+ point increase in their credit score.

Join the homeowners who improved their credit scores within 30 days.

Credit's Complicated. We're here to help.

How does my credit score impact my monthly mortgage payment?

Should I just start paying down my balances to optimize my credit?

What’s the difference between credit repair, credit counseling and CreditXpert?

Credit repair and credit counseling are services performed by teams of people that provide guidance to consumers who need help with credit disputes or improving their money management skills. CreditXpert has developed sophisticated predictive analytics to help mortgage applicants achieve the highest credit score possible. Our tool generates custom plans with actionable steps to raise your score, such as paying off a loan, opening a new card, or requesting a balance increase.

How do I lock in my new credit score?

You’ll be connected with lenders that can create a custom improvement plan with using CreditXpert’s proprietary technology for lenders. The improvement plan will include the specific steps needed to reach your target score. All you have to do is complete the recommended steps. Are you already working with a lender? Send them your credit potential report and they can contact CreditXpert directly.

Get the best deal on your mortgage.

Our free tool makes good credit scores great. So you can go all out on your housewarming party.

As a lender, you have options when pre-qualifying borrowers for a mortgage. You can run a soft or hard credit pull. Soft credit pulls offer more benefits, increasing your chances of keeping the lead and saving you money. Sometimes a lot of money — depending the on the credit reporting agency, a soft credit pull could be just a quarter of the cost of a hard credit pull.

Mortgage loan fallout—approved loans that fail to close—costs lenders money, time, and relationships. Causes range from credit score declines and rate lock expirations to appraisal issues and borrower disengagement. Targeted strategies like pre-closing credit monitoring, smart lock management, and strong borrower-agent engagement can reduce fallout, improving profitability, efficiency, and market reputation.

Loan officers often face declined applications from near-prime borrowers who narrowly miss credit score thresholds. Credit score optimization turns these declines into approvals by pinpointing high-impact actions that can boost scores within 30–60 days. Advanced tools offer borrower-specific recommendations, automate credit report analysis, simulate “what-if” scenarios, and integrate with credit bureaus — accelerating approvals while ensuring compliance. Choosing the right platform can increase funded loans, revenue, and borrower trust.

Mortgage conversion rates tell the real story of a lender's performance — and the gap between average and top performers often comes down to what happens after a rough application. Many credit-related declines involve borrowers who are surprisingly close to approval. With the right guidance and credit optimization tools, those near-misses become closed loans. The difference isn't more leads. It's doing more with the pipeline you already have.