The browser you are using is not supported. Please consider using a modern browser.

Mortgage expert, meet CreditXpert

The only credit optimization platform that uses predictive analytics to help today's top brokers qualify more applicants, make better offers and close more loans.

Supported by every major credit reseller and credit platform

Getting approved for a mortgage shouldn't be your clients' biggest challenge.

Whether your borrower has a 560 or a 760, CreditXpert can help you make better offers and close more loans.

Incubate

Qualify

Introduce

Expand

Close

How to Qualify More Borrowers and Closing More Loans with The NEW Credit Optimization Playbook

Download PDF

Every broker is a mortgage powerhouse.

You may be a small team but CreditXpert turns your brokerage into a strategic growth engine by maximizing the credit potential in every borrower.

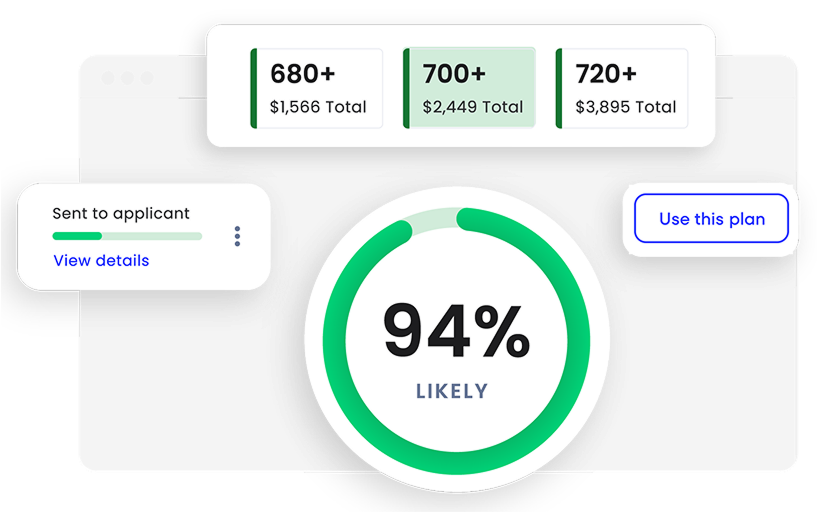

The new CreditXpert brings you everything from Wayfinder and What-if Simulator but makes it way easier to use. It places every applicant's potential right in front of you. With the click of a button, you can generate multi-bureau credit optimization plans with actions and the likelihood of reaching a target score. Share the plan and track the applicant's progress.

Identify

IDENTIFY: See the applicant's credit potential right in front of you.

Generate

GENERATE: Generate an optimization plan with 1 click.

Track

TRACK: Send the plan and track the applicant's progress.

Everyone wins with CreditXpert.

Mortgage Brokers

- Convert more leads

- Qualify more applicants

- Make more competitive offers

- Lower LLPA premiums

Homebuyers

- Qualify for better loan programs

- Lower your interest rate

- Reduce your private mortgage insurance premiums

- Know that you got the best deal on a mortgage

Realtors

- Help more clients qualify

- Help clients secure the best rate

- Help clients reduce PMI

- Help increase client purchasing power

No monthly fees. No plan minimums.

Pay as you go.

Maximize your brokerage’s power by creating a FREE CreditXpert account today.

NO MONTHLY FEES. NO PLAN MINIMUMS. PAY AS YOU GO.

Pay $28 per tri-bureau plan and get instant access to CreditXpert’s powerful credit optimization platform. View your borrowers’ credit potential, generate tri-bureau automated plans, send plans and track borrower progress online.

Small Team

- No monthly fees

- No plan minimums

- $28 per tri-bureau plan

- Pay for plans as you go

- Add up to 20 team members

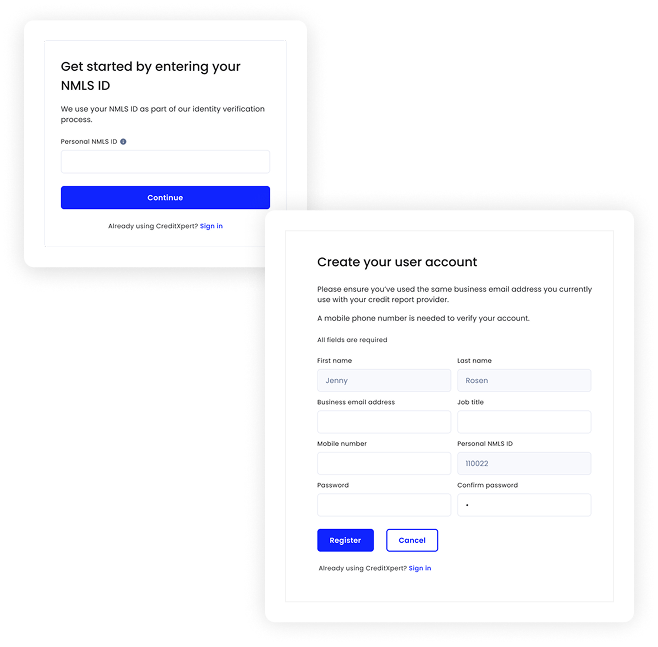

Creating a free CreditXpert account is easy. Get started today.

- Enter your NMLS ID

- Information about you and your company

- We seamlessly connect your credit data from your credit reseller for free

Pay by credit card for each plan as you go.

-

Prime LendingRod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site. When the client learned that this meant his rate would be a quarter of a percent higher, he was ready to walk away from both the loan and the property. Rod convinced his client to reconsider, believing he could find a way to help improve the credit score. When analyzing the credit picture, Rod saw that his client had co-signed on a furniture purchase for a family member who hadn’t yet paid it off. Using CreditXpert, Rod discovered that his client’s score would increase just enough to qualify for a better rate if he paid the balance down by $1,000. Once the client completed the action, Rod rescored him at the higher credit score and secured a lower rate – saving $37,800 over the life of the 30-year mortgage.

Prime LendingRod’s client was eager to secure a loan for a vacation home. When Rod pulled the credit report, he noticed that the score was 698 – 18 points less than what his client saw on a free credit score site. When the client learned that this meant his rate would be a quarter of a percent higher, he was ready to walk away from both the loan and the property. Rod convinced his client to reconsider, believing he could find a way to help improve the credit score. When analyzing the credit picture, Rod saw that his client had co-signed on a furniture purchase for a family member who hadn’t yet paid it off. Using CreditXpert, Rod discovered that his client’s score would increase just enough to qualify for a better rate if he paid the balance down by $1,000. Once the client completed the action, Rod rescored him at the higher credit score and secured a lower rate – saving $37,800 over the life of the 30-year mortgage.

Secure, compliant and always on.

-

ISO Certified

-

AICPA Service Organization

-

AICPA Service Organization